An HDHP, especially when paired with an HSA, is one of the best options for a large segment of employees. With healthcare costs ballooning, these plans can result in significantly reduced healthcare expenditures for many healthcare consumers.

The only problem is the branding. High deductible? That sounds scary. It makes employees envision runaway medical costs, or putting off minor medical care to avoid medical bills. But this couldn’t be further from the truth. And, with a little education, you can help employees to understand if an HDHP + HSA is the right plan for their physical and financial health.

There are a lot of methods to handle this education, from PDFs to employee videos to a benefits decision-support tool. But, a good place to start is an email to your employees and the below email template will set you on the right path.

(Related Guide: Benefits Decision Support: Your Secret Weapon for Reducing Healthcare Spending)

This is a long email, but it is a complicated topic. We believe that if you send some variation of this to your employees, you’ll start to close some of that knowledge gap.

HDHP/HSA Email Template

Subject Line: Why a High-Deductible Health Plan May Actually Mean Lower Costs for You

Hi [NAME],

You have a few different, exciting options available to you for health insurance this year. One plan type (our “high-deductible health plan with HSA”) might not be that familiar to you, so we wanted to give you an overview of some of its benefits and drawbacks so that you can make an informed decision.

What is a high-deductible health plan (HDHP)?

It’s exactly what it sounds like. It’s a plan with a higher deductible, which means that, depending on the type of services, you may have to spend more on medical care until you surpass your deductible. However, that doesn’t mean your overall healthcare costs for the year will be higher; in fact, they may actually be lower.

Benefits of an HDHP:

- You get more money in your pocket. Your monthly premiums are lower, so your paychecks are larger. If you rarely access medical services as it is, you’ll save a whole lot of money.

- Preventative services are still covered. While some medical care is subject to your deductible, many types of preventative services (such as annual health exams, cancer screenings, and immunizations) are covered.

- Lower out-of-pocket maximum. If a major medical emergency hits, the lower out-of-pocket maximum means you’re likely to pay less overall to cover that emergency.

- Pay bills with pre-tax money. When paired with a well-funded HSA, you’re able to pay for many of your medical bills with pre-tax money, which means your income goes further. HSAs are the only “triple-tax-savings instruments.” Pre-tax going in, no tax on investment gains, and no tax on using for qualified expenses.

Drawbacks of an HDHP:

- You may not have the funds to cover a large, unexpected medical expense. Say you have a sudden $800 medical expense, and you haven’t hit your deductible yet. You’d likely have to pay this out of pocket. But, a little planning, including investing in your HSA (more on that later), can mitigate this.

- It’s not a good fit for moderate medical users. If you frequently see doctors, specialists, of frequently fill name-brand prescriptions, you’re probably better off with a traditional plan.

What is a health savings account (HSA)?

An HSA is a tax-advantaged savings account that can be used on healthcare needs. This type of account is often paired with an HDHP, as it enables you to use tax-free dollars to save for medical expenses. Not only are your contributions tax free, but the money is yours for life, can be invested (like a retirement account), and any investment gains are also tax free.

Importantly, money in this type of account can be rolled over into future years. So, once you feel that it’s comfortably funded, you can take full advantage of the reduced premiums that come with your HDHP.

If you don’t end up needing these funds, they can be stashed away forever. It’s your account, it’s your money. It can be invested like any other retirement account and will gain tax free until you’re ready to begin withdrawing money at retirement.

Who is a good fit for this plan?

The employees that are the best fit for these plans are healthy employees with infrequent use of medical services beyond preventative care. This type of employee would save a lot of money because of the reduced monthly premiums.

And employees that are able to fund their HSA will find this option even more attractive, as you can pay for your occasional medical, mental, dental, and vision expenses with pre-tax income, while also saving for retirement with tax-free investment gains. Not only that, but you can often use HSA funds on many everyday items, like birth control, over-the-counter medication, first aid supplies, contact lenses, and even sunscreen.

Some employees who regularly surpass their out-of-pocket maximums might also find this plan to be more financially prudent, but you’ll want to spend some time with our benefits decision-support tool to see if you would save money over the course of the year.

Who is not a good fit for this plan?

If you regularly use medical services, this may not be the right plan. For example, if you manage a chronic condition that requires doctor visits and high-cost monthly prescriptions, a traditional plan (like Company Plan Option A or Company Plan Option B) might be more suitable.

What are the specifics of our HDHP plan?

You can get these specifics in our benefit guide, but here are the most important things to know. As an added benefit, we contribute monthly to your HSA to help cover medical bills for HDHP users.

- Your monthly premium: $

- Your plan deductible: $

- Your out-of-pocket maximum: $

- Your copay/coinsurance/prescription costs: $

- Your HSA contribution limit: $

- Your monthly employer contribution to your HSA: $

- Preventative services covered: _____, _____, _____, _____

How do you enroll?

If this seems like a plan that is a good fit for you, here is how you enroll:

- Step 1

- Step 2

- Step 3

- Step 4

- Step 5

Got questions?

If you have any questions about this plan type, or any of the other plans, please let us know. Here are some resources available to you:

- PLANselect, our benefits decision-support tool. Anonymously answer a few key questions about medical needs, and this tool will calculate your expected medical costs and compare them against your available plan options.

- Access the benefits resource center. Download plan guides, read materials, and access calculators and other resources in our benefits resource center.

- Contact your enrollment advisor. Name (email@email.com) is ready to answer any of your questions from 9am-5pm, Monday through Friday.

Why This Email Works

It’s comprehensive but uses plain language. This helps simplify what can be complicated subject matter. It also takes an honest accounting of the benefits and drawbacks of this plan type — an essential inclusion to make sure employees feel informed, respected, and are able to make a decision that is right for them.

At the same time, it’s also persuasive. It lays out the benefits clearly, and makes a strong case that removes the “scare factor” of the high-deductible language while appealing to the right-fit employees.

It also clearly goes over an HSA and the significant advantages they provide. Very few employees understand HSAs, how they are different from FSAs, and how they serve as both a medical bill safety net and a retirement account.

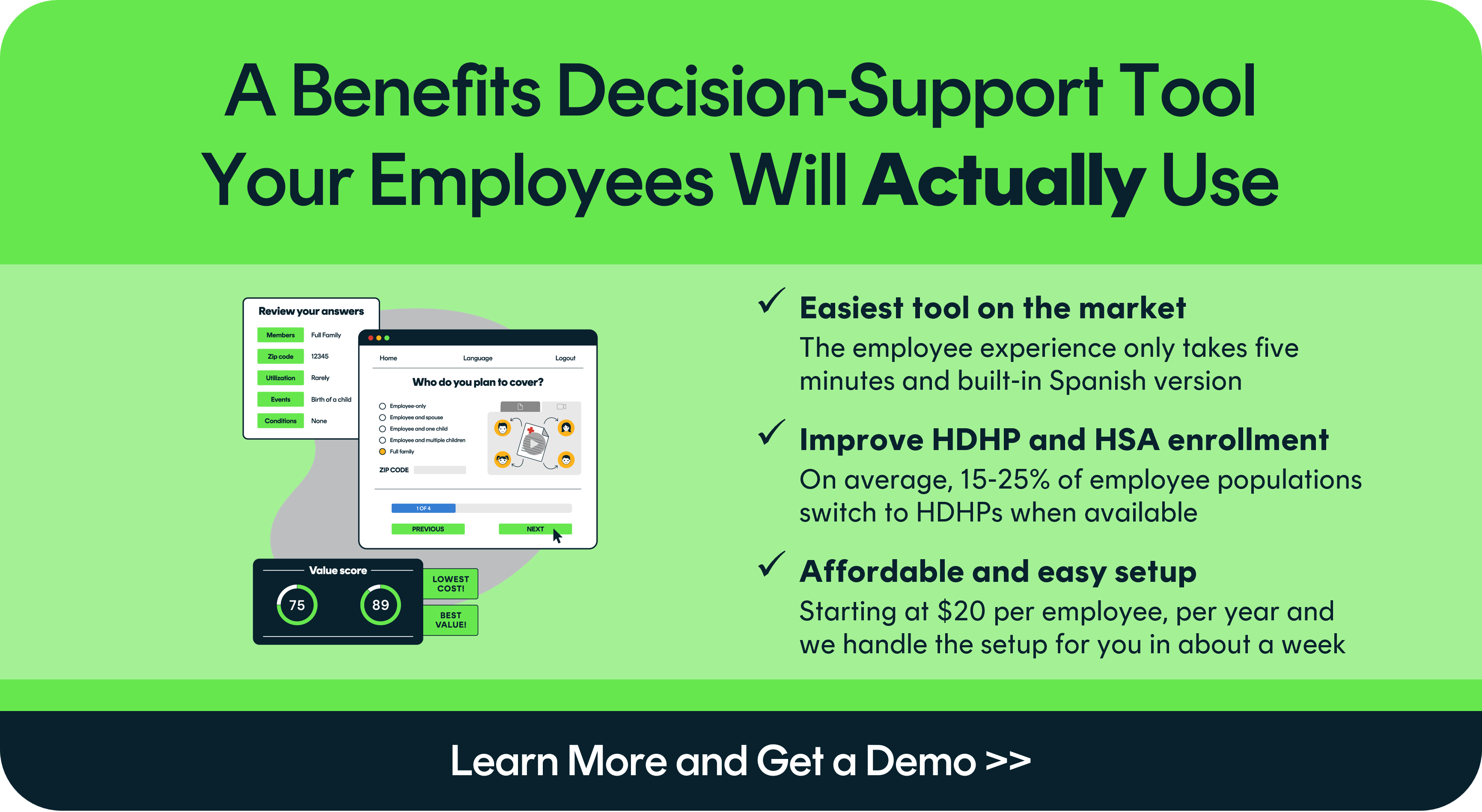

Another Way to Improve HDHP and HSA Enrollment: A Decision-Support Tool

Choosing a plan that is both the right medical decision and the right financial decision is a complicated task. Employees really struggle to do the math and understand the financial impact of different plans.

But a decision-support tool, after asking a few key questions, can make a complex decision into an easy one by allowing employees to easily compare their options and predict their costs with each plan.

It’s easy to stress about making a wrong decision when you struggle to do the complex math involved. But, when the financial impact is laid out for the employee, the decision to enroll in an HDHP becomes obvious to the right-fit employees.

This is why the average employer using a decision-support tool like PLANselect sees a 15-25% shift in enrollment to their HDHP plan option.