IRS Announces 2023 Increases to Health FSA and Transportation Fringe Benefit Limits

Proskauer's Employee Benefits & Executive Compensa

OCTOBER 21, 2022

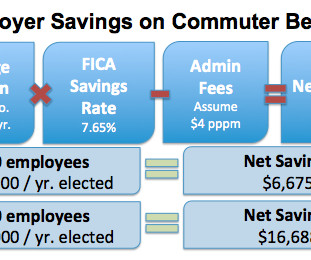

On October 18th, the IRS announced a slew of inflation adjustments for 2023, including to the annual contribution and carryover limits for healthcare flexible spending accounts and the monthly limit for qualified transportation fringe benefits. Qualified Transportation Fringe Benefits. . The new limits are set forth below.

Let's personalize your content