By Kisha Moliere

It is common to think of benefits administration technology (ben admin) platforms as a tool that only facilitates employee benefits enrollment and transfers benefits eligibility data between carrier and payroll systems. However, ben admin platforms can also leverage modern technologies to alleviate HR administrative burden and improve employees’ overall benefits experience. Below are a few examples.

Decision Support

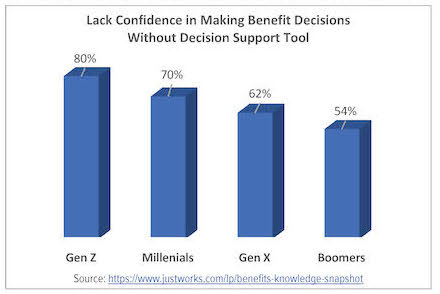

Think your employees aren’t interested in decision support? Think again. A 2022 Harris poll found that 72% of employees said “they wish someone would tell them what the best health insurance for their unique situation is.”1 This tracks closely with data from Nayya’s 2022 Employee Engagement and Benefits Trends report in which more than 70% of Millennials and Gen Zs indicated they were not confident in selecting benefits without a decision support tool.2 If your current ben admin platform does not leverage a decision support tool, you are missing an opportunity to improve your employees’ confidence in their benefits decisions as well as the value they assign to them.

Be mindful that not all decision support tools are created equal. The best options are hosted within the employee enrollment experience; automatically provide guidance based upon the employee’s data already contained within the

system; cross references that data against large claims databases; and offers employees the opportunity to further customize the recommendation through personalization. PlanSource’s Decision IQ is an example that incorporates all of the above – boasting a 100% utilization rate. TBX’s Benefits Genius is another intelligently designed decision support tool that is used by 87% of employees – with 85% of them electing the recommendation.

Virtual Assistants

Employees often struggle finding pertinent benefits information at the time of service (i.e., after work hours or on weekends). Does your current ben admin solution have a Machine Learning (ML) enabled virtual assistant to guide employees to the answers they need – when they need them? Different than a simple chat bot, these enhanced tools can guide an employee to their specific plan information 24/7, 365 days a year. Using natural language patterns, employees can ask questions about their specific benefits as well as how to navigate the system. Taking it a step further, virtual assistants can also drive users to underutilized benefits, such as telemedicine, when an employee asks a question like “what is my emergency room copay?” Businessolver’s Sophia and My Benefit Express’ Expresso are great examples of this type of technology.

Automated Dependent Documentation Verification

Could your HR team better use the time they spend manually collecting and verifying dependent documents for New Hire enrollments and Qualifying Life Events (QLEs)? Artificial Intelligence (AI) and Machine Learning (ML) can be utilized to identify and approve valid documents. By utilizing AI/ML, PlanSource’s Dependent IQ automatically approves over 90% of the most common documents like birth certificates and marriage licenses, and an average of 65% of all documents it is continuously trained on such as domestic partner affidavits, federal tax returns, etc. Auto-approved documents will then trigger updates to carriers and payroll – without the need for an administrator’s involvement.

Auditing with AI

Anyone familiar with ben admin platforms knows the term “garbage in, garbage out” due to never-ending discrepancy headaches produced when errant data flows between their payroll, ben admin and carrier platforms. Wouldn’t it be nice if your ben admin system utilized artificial intelligence to identity and help eliminate errors these errors? Benefitfirst is a provider that does just that – perpetually validating your data to optimize eligibility accuracy and improve systems synchronization. This not only generates time savings, but also premium savings because of discrepancy resolution.

Evidence of Insurability APIs

Is your organization still utilizing paper forms or electronic PDFs to manage the Evidence of Insurability (EOI) process for voluntary life and disability plans? The adoption of EOI APIs could dramatically streamline this process for both the employee and HR administrator. Platforms with these established connections allow the employee to complete EOI within the enrollment experience – eliminating the need for HR to track and manage EOI submissions to carriers. Some of the more sophisticated APIs, such as ones being deployed by PlanSource, allow the carrier’s decision to be fed back to the ben admin system, completely automating the process of updating the coverage and payroll deductions.

Carrier Eligibility & Payroll/HRIS APIs

The emergence of carrier eligibility APIs offer the potential to greatly enhance the HR administrator experience. These real time eligibility transfers – when compared to weekly EDI file feeds – improve systems synchronization. A less obvious, but just as important, downstream impact is significant reduction of billing discrepancies and time spent on mundane tasks such as billing reconciliation. In the large group space, PlanSource is already leveraging these type connections with several carriers.

Becoming more common for even entry level platforms like Employee Navigator and Ease – payroll APIs greatly reduce the need for duplicative data entry into a client’s payroll/HRIS and ben admin systems. Having near real-time connectivity between the payroll/HRIS and ben admin systems means employee demographic data – including status changes (active to term for example) – and payroll deduction data are updated on a more frequent cadence, without any action from an HR admin.

AI Enabled Benefits Education

According to a recent study by the Hartford, “76% of employers say educating employees about benefits” remains challenging.3 This is not surprising considering most benefits communication materials are presented generically to all employees in written word. However, the way in which employees comprehend benefit information varies greatly based on their current stage in life. For example, effectively articulating the value of a medical or critical illness plan to a Baby Boomer requires very different scenarios than ones used for a Millennial. TBX is a provider that takes an innovative approach to this challenge. They leverage behavioral science, AI, and customized videos within the employee’s enrollment experience to bridge the gap in benefits comprehension and deliver hyper-personalized education resulting in improved understanding of and participation in the benefits offered by their employers.

If your ben admin technology platform is not providing any of the above advances to reduce administrative burden and enhance employees’ benefits experience, it may be time to review new solutions.

Sources:

1 https://www.justworks.com/lp/benefits-knowledge-snapshot

2 Nayya Unpacking the Healthcare Crisis: 2022 Employee Engagement and Benefits Trends

3 The Hartford’s 2022 Future of Benefits Report

Vice President & National Practice Leader

Benefits Administration Technology

McGriff

kisha.moliere@mcgriff.com

McGriff.com