Healthcare has never been especially affordable in the U.S., regardless of one's employer or health plan. Americans are in nearly $200 billion worth of nationwide

Despite over 90% of the U.S. population having some form of health insurance, an estimated 41% of adults carry medical debt, according to the Kaiser Family Foundation. On top of that, the average cost employers pay for their employees' healthcare will jump by 6.5% in 2023, amounting to more than $13,800 per employee, according to professional services firm Aon.

Where does this leave employers, who provide half of the American population's health insurance? While some employers may be in the financial position to cover even more of their employees' premiums, others may not be able to absorb the added costs, subsequently leading their employees to delay or avoid seeking care because they cannot afford it. For those who make less than 200% of the federal poverty level, which in a four-person household falls at $60,000 in annual income, management consulting company McKinsey predicts that healthcare spending could take up as much as 75% of their discretionary income.

Read more:

In a year that began with massive layoffs alongside continued interest rate hikes, benefit leaders are in for a challenging road ahead. But if employers want a healthy and productive workforce, they will have to reconsider their own benefit decisions and whether all their employees are actually benefiting in today's economic landscape.

New research from Arizent — parent company Employee Benefit News — reveals where employers and employees see eye-to-eye on their

In healthcare, no plan is foolproof

A majority of employers believe they are offering their employees the best benefits possible, with 70% rating their organization's benefit options as more maximal than minimal. And yet, 68% of the same employers feel their benefit design is ultimately limited by their budget. In other words, while employers generally feel they are doing the best they can on the benefits front, they are still financially constrained from giving more.

Read more:

However, this hasn't stopped benefit leaders from trying to get creative; 53% feel their benefits are more innovative than traditional. Notably, companies who described themselves as more innovative also were more likely to carry more healthcare benefits, with over 80% of these companies having digital health tools for healthcare navigation, fitness tracking, chronic condition management and overall wellness help. Just under 70% carried family-building benefits, too.

Whether or not the employer deems themselves innovative, most can agree on the importance of evaluating their current benefit offerings each year. Only 15% admit to simply rolling over their previous year's selection of benefits. And the bigger the company, the more time benefit leaders spend on their decisions. Companies with over 2,000 employees are twice as likely to dedicate a lot of time to benefit selections.

Where do employers turn to make these decisions? It seems several tools come into play, with 65% of employers naming benefit consultants, 62% using utilization data from existing benefits and 58% reviewing employee surveys and claims data from medical plans. Still, many employers may be missing a significant part of the picture since only 16% look at social determinants of health, which can reveal how their employees' physical environment as well as their political, social and economic status influence their health outcomes.

Tried and true benefits still take the lead

As for employees, they agree that the most commonly delivered benefits are also table stakes benefits — namely, health, dental and vision insurance alongside paid sick leave. But when it comes down to what everyone desires to see as part of the benefits package, there is less of a consensus. A whopping 50% of respondents want benefits related to gym access, 42% want benefits related to nutrition support and 41% want company-provided wellness activities like group yoga and meditation.

Other benefits that could be vital: 34% of employees want mental health support, 29% want chronic condition support and 28% want family-building assistance, whether that was in the form of fertility care or adoption benefits. Bottom line: employees notice when a benefit they need is missing.

Read more:

However, when it comes down to what benefits are being used the most, mental health support, family-building assistance and paid parental leave land towards the bottom, while more standard benefits like health insurance, dental insurance, paid sick leave and vision insurance are at the top.

While this may sway employers from investing in more "innovative" healthcare benefits, it's crucial to note that receiving mental health help, let alone taking weeks or months off to care for a new child, may be subconsciously frowned upon in the employee's work culture or discouraged by management. Just because a benefit is there, it doesn't mean the employee will feel empowered to use it.

Telehealth is part of the new normal

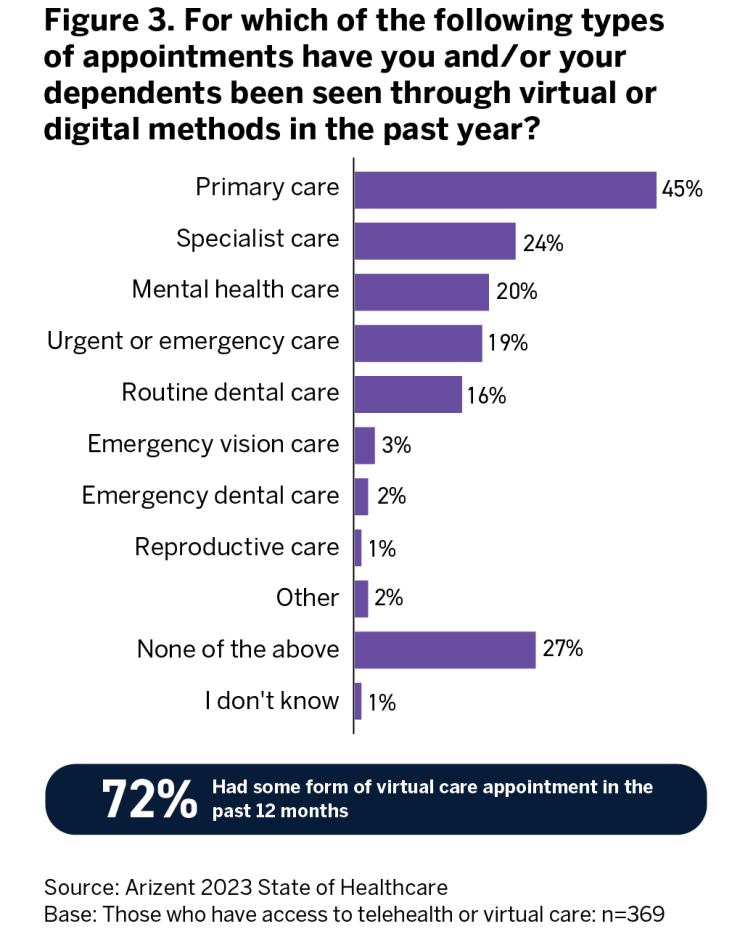

Over 70% of the employers surveyed have telehealth offerings, and given its increasing popularity as a result of the pandemic, that number is likely to go up in the next few years. Unlike some other supplemental wellness benefits, telehealth sees high utilization rates, with 72% of employees having participated in some form of a

A majority of respondents noted that telehealth did not increase the number of appointments they booked — although this statement may ring less true depending on the employee's generation. Half of Gen Z employees did report their number of appointments increasing, at least by a little. Of course, a certain familiarity with technology will play a role in whether employees feel comfortable accessing their care via phone call, text or video call.

As for employees who have access to digital health tools, 25% feel they have helped address their mental health challenges. On the downside, 36% did not feel they addressed any listed issue, whether it was a chronic health condition, a cognitive disability, fertility issues or mental health struggles. This may signal to employers to be more critical of the digital tools they add to their healthcare benefits.

Read more:

Healthcare navigation is on employers' radars

The U.S. is notorious for its complicated healthcare system. Patients find themselves going between their employers, insurance companies and hospitals to pinpoint what treatment they can receive, who the provider will be, and if they're lucky, the estimated cost of care.

Especially in the last few years, employers realized their workers might need guidance on not only what benefits they should pick but how to use them. Notably, half of employers report providing active support for employees in choosing a health plan and predicting how much care will cost. Likewise, 68% of employers claim they are more confident than not that their employees have the tools they need to make the best healthcare decisions — despite the fact that half of the same employers did not feel confident about their healthcare navigation benefits.

Granted, companies who fully paid for a healthcare navigation service for their workforce were 20% more confident than companies that did not provide this benefit. While employers may have some uncertainty around whether their chosen service itself is effective, having it boosts their belief that their employees can make better healthcare decisions than before.

Companies name several factors pushing them to include a healthcare guidance tool, and cost did not rank number one. Nearly 80% of employers were motivated to include it in the hopes of providing a better employee experience, 54% wanted to improve health outcomes and 52% wanted to reduce costs.

Read more:

As for those who haven't adopted healthcare navigation, 36% feel they are likely or very likely to include it, listing cost reduction as the main driver. This signifies that employers who are looking to revise their current benefits now have cost top of mind, compared to employers who already have a navigation benefit. This is more than understandable given the economic landscape.

Care doesn't come cheap

Employers aren't blind to the

However, some employers are still slightly underestimating just how many employees find the cost of care challenging — 66% of employees say the cost of receiving care through their current health plan is too expensive, and only 32% say the price is appropriate (Figure 4). This small discrepancy in employers' and employees' perception of cost could ultimately appear in benefits decisions. Employers may want to have a better pulse on how their specific work populations feel about what they pay for care.

On top of healthcare being so costly, employees often cannot anticipate just how expensive their treatment will be. Over half of employees felt their care was more expensive than expected in the last year; this number jumps to 60% for those with chronic conditions. Nearly 30% had to pay an unexpected medical bill in the past two years. It seems many employees do not feel their health plan is truly making care accessible or affordable.

Read more:

On the bright side, there are points of care employees view with less fear around cost. Over 80% of employees do find telehealth and primary care easily affordable or affordable. Employers should note, however, that approximately a third of employees have trouble affording specialist care, urgent or emergency care, dental care and imaging (Figure 5).

Oddly enough, nearly 80% of employers scored their

The path forward

Employers and employees know healthcare is too expensive, with many employees feeling their care was more costly than expected. But employers struggle to provide effective shopping tools in order to help employees become informed consumers. Fortunately, a majority of employees agree that there are affordable points of care, namely telehealth and primary care. Employers may want to work on ensuring their employees can also afford specialist care, emergency and urgent care as well as lab and imaging appointments. It would be a mistake to assume insurance plans make most services affordable.

Read more:

Alongside costs, employees also find it difficult to find providers and book timely appointments, which may delay necessary care. A majority of employees can at least say they have positive experiences once they see a provider, but one's race, gender and sexual identity can impact the quality of treatment. Employers may want to prioritize factors like patient satisfaction and timeliness of care when making benefits decisions.

It's no secret that healthcare prices are only going up from here — employers need to be honest about whether their current benefits will keep care accessible and affordable. Benefits that fail to do this will only cost employers more in the long run.