Top tips for boosting employees’ pensions knowledge

Employee Benefits

NOVEMBER 15, 2023

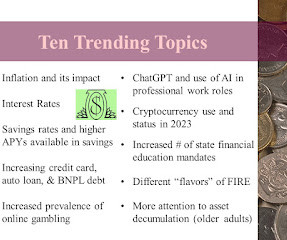

Need to know: Employers can tailor content and communication channels to different employee groups to help with their pensions knowledge. Losing the jargon will make the language of pensions easier to understand and more relevant to staff. They could invest in financial coaching for a more personal approach to pensions education.

Let's personalize your content