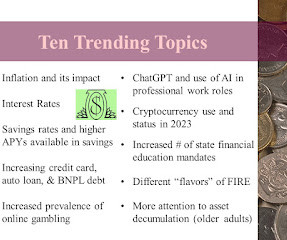

2022 Personal Finance Year in Review

Money Talk

JANUARY 4, 2023

Last month, I presented my eighth annual (2022) Personal Finance Year in Review webinar for OneOp. Taxes - The average income tax refund in 2022 was $3,039, but some families with advanced child tax credits faced tax payments. Some states held sales tax holidays in response to high inflation. in November.

Let's personalize your content