You went to the local pharmacy, picked up your medicine, and then received a request for substantiation a few days later. If you’ve ever wondered, “what is substantiation and why is it required?” you’re not alone.

Let’s start with the basics.

What is substantiation?

Within the tax code, there is a rule that states every expense or transaction from an FSA or HRA must be substantiated. This means there needs to be proof or evidence that the funds were only used for eligible medical expenses. When using a pre-tax benefits card to access these funds, certain systems or rules try to automatically prove the funds were used as intended. But, sometimes the systems and rules can’t prove this. When this occurs, you might be asked to provide “documentation support” or receive a “receipt request”.

It may go something like this:

- You have a medical-related purchase or service that is (as far as you know) an eligible expense.

- Then, you use your pre-tax benefits card to pay for the expense.

- A few days later, you receive a “request for substantiation”.

- You aren’t sure why you’re receiving a request for substantiation since your card went through and you were confident it was eligible.

We understand that receiving a request for substantiation can be frustrating. Many people wonder why they need to submit documentation if the original transaction was approved. Sometimes, people are offended that their transaction is being questioned as an eligible expense.

We hear you, and want to clear up any confusion.

Why is substantiation required?

It is kind of like the old saying: “if you are living under my roof, you will live by my rules”. Only, the “roof” is the IRS.

It is a little bit of give-and-take. The IRS is permitting you to use the funds in an FSA or HRA on a tax-free basis. In exchange, they require evidence that funds were used for eligible expenses. Employers hire companies like Benefit Resource (BRI) to ensure these requirements are met. And ultimately, the employer can continue to offer their employees these tax-free benefits.

When you see a substantiation request come through from BRI, we’re simply asking you to provide evidence that the expense was eligible. This is because we didn’t receive enough information to confirm it automatically.

Why did you approve my transaction only to decline it later?

Your benefit card is designed to work at stores where most of the items sold are eligible. But, many of these places also sell ineligible items or services (e.g. a local pharmacy).

When you pay for an item at these locations, your transaction is approved assuming you likely purchased an eligible item. The transaction information is reviewed against a series of rules and previous activity to determine if we have enough information to ensure it is eligible. The problem is, the transaction information that is passed doesn’t typically indicate WHAT was purchased.

Why do certain expenses seem to be flagged for substantiation ALL THE TIME?

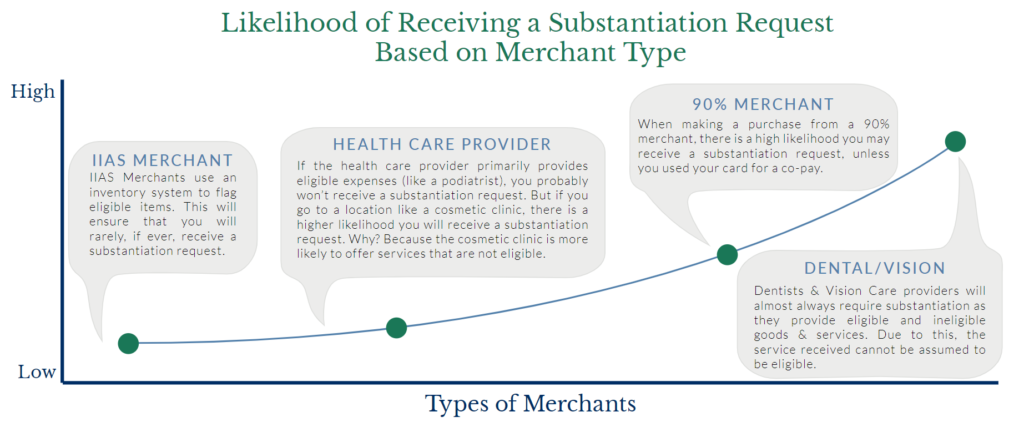

Where you buy a service or item has a greater influence than what you buy on whether you receive a request for substantiation. That’s why, in some cases, you could buy the exact same item at two different locations and only be asked for supporting documentation on one item.

There are different kinds of merchants (businesses or places that provide medical services) that will impact how often you receive a substantiation request.

| IIAS merchant | IIAS Merchants use an inventory system to flag eligible items. This will ensure that you will rarely, if ever, receive a substantiation request. |

|---|---|

| Health care provider | If the health care provider primarily provides eligible expenses (like a podiatrist), you probably won’t receive a substantiation request. But if you go to a location like a cosmetic clinic, there is a higher likelihood you will receive a substantiation request. Why? Because the cosmetic clinic is more likely to offer services that are not eligible. |

| 90% merchant | When making a purchase from a 90% merchant, there is a high likelihood you may receive a substantiation request, unless you used your card for a co-pay. |

| Dental/Vision | Dentists & Vision Care providers will almost always require substantiation as they provide eligible and ineligible goods & services. Due to this, the service received cannot be assumed to be eligible. |

But, don’t you get the information you need from my provider?

“I used my card. It provided all the information BRI needed, right?”

Not exactly. Transaction information is generally limited to date, merchant, merchant type, and amount. It doesn’t generally indicate WHO the service is for or WHAT was provided. Additionally, it is not as simple as picking up the phone and asking for the information. HIPAA privacy rules and security standards prevent health care providers from freely sharing those details. So, when it’s possible the expense is ineligible and information is not available, you receive a request for substantiation.

Tired of receipt requests?

Check out our blog on best practices to avoid receipt requests.