Gross pay vs. net pay: What's the difference?

PeopleKeep

JULY 27, 2023

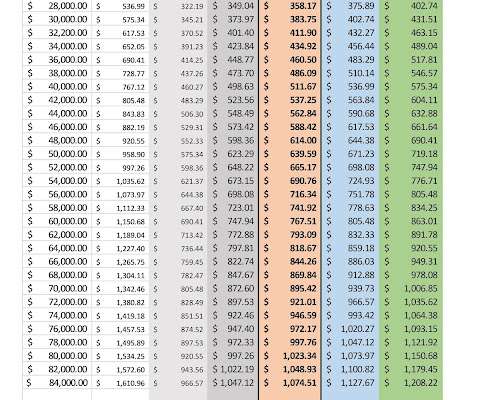

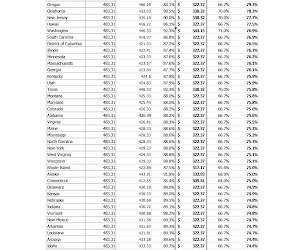

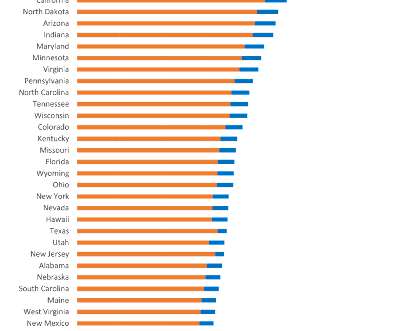

Whether you employ hourly or salaried workers, you must understand the difference between gross and net pay. Understanding how certain deductions and your tax obligations factor into both gross and net pay can help you run a smooth payroll process.

Let's personalize your content