Bayzat’s latest feature: Payroll & Accounting Integration allows you to manage two systems in one place. No more duplicate entries, no more manual tasks. Pay your employees the right amount and on time – at the click of a button.

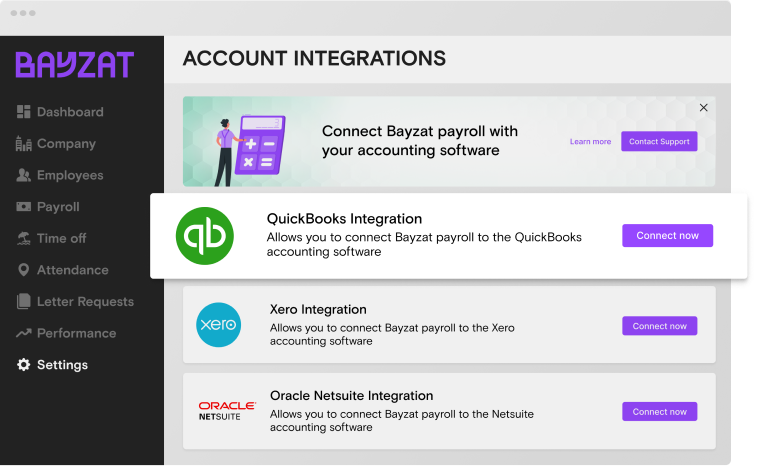

Automate your payroll processes and integrate your payroll with one of the top three accounting softwares in the UAE. Bayzat’s latest feature: Payroll & Accounting Integration takes away the mundane task of month-end, reduces the hours you spend reconciling data and automates your processes so you can get on with the more pressing tasks at hand.

Top 6 payroll & accounting challenges and how to overcome them

Managing payroll can be a real burden, especially when you have hundreds of other accounting tasks that need your attention every day. When handled manually, calculating wages, taxes and other payroll deductions can be a tedious and time-consuming process that requires precision to ensure your employees are paid fairly, and that the company complies with all regulations.

Challenge 1: Duplicate Data Entries Across Multiple Systems

If your payroll isn’t integrated with your accounting system, your finance managers have to enter payroll data multiple times – in both your payroll and accounting system – a tedious task that can be easily avoided.

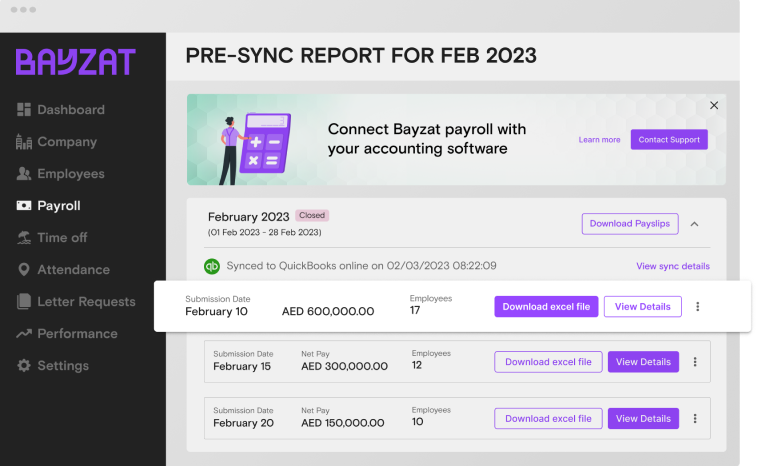

Bayzat has simplified the entire payroll process with a smarter, faster accounting integration that enables you to import payroll data, making it easier for you to automate the entire payroll and bookkeeping process. The integration also helps you to accurately track payout records that are pushed automatically, which if not done manually can be a time-consuming process.

Challenge 2: Manual Entries and the Risk of Human Error

Manual payroll processing is a tempting option, especially for SMEs. But it’s an error-prone solution that can take up a lot of time and energy. And as your business grows, so does the complexity and risk of manual processing. Not only do you battle to keep up with the multitude of spreadsheets, but calculating gross pay, allowances, overtime pay, reimbursements, tax, and other deductions becomes a mammoth task.

With Bayzat’s Payroll & Accounting Integration feature, you can have peace of mind that all your data is aligned, calculated correctly, synchronized and reconciled across both systems.

Challenge 3: General Ledger (GL) Posting and Reconciliation Delays

It’s no secret that disconnected systems such as payroll and accounting can create a huge headache for business owners. It’s not uncommon for manual processes to be required to post payroll data to the general ledger, leading to endless reconciliations and potential compliance and audit risks.

Our integrated payroll and accounting solution eliminates the need for manual postings and reconciliations, with a seamless integration of your payroll and accounting systems. Gone are the days of having to manually import files, log in multiple times, and manually reconcile payroll costs to the general ledger. Our solution requires just one login and uses a single chart of accounts for both systems, making it easier to track and manage payroll data.

Challenge 4: Data Compatibility

One of the biggest challenges of integrating payroll and accounting systems is ensuring the data is compatible. They often use different data formats and structures, making it difficult to transfer data between them.

Bayzat Payroll’s accounting integration feature solves this challenge by automatically mapping fields and formats, ensuring the data is entered correctly and consistently across systems. This eliminates the need for manual data entry and greatly reduces the risk of errors.

Challenge 5: Complex Regulations

Payroll and accounting regulations vary by country, state, and industry, making it challenging for businesses to comply with all relevant laws and standards. Employers must ensure they are withholding the correct taxes, making timely payments, and filing accurate reports.

Bayzat Payroll’s accounting integration feature is designed to comply with all relevant payroll and accounting regulations, including local tax laws, social security requirements, and more. This ensures businesses can stay compliant and avoid costly penalties.

Challenge 6: Limited Automation

Many payroll and accounting tasks still require manual input and processing, which can be time-consuming and error prone. It can also lead to delays in payment and compliance issues.

Bayzat Payroll’s accounting integration feature automates many payroll and accounting tasks, such as salary calculations, tax deductions, and reporting. This reduces the need for manual input and processing, freeing up time for businesses to focus on other areas of their operations.

When it comes to running a successful business, efficient payroll and accounting processes are essential. A smooth and accurate payroll system will not only ensure that employees are paid correctly and on time, but also that your accounts are in order. But with disconnected systems, manual processes and delays, it can be easy to get bogged down in the details. Here are a few tips to run an effective payroll department.

5 Factors to consider when integrating your Payroll and Accounting

Read More : https://www.bayzat.com/blog/payroll-integration-and-how-it-boosts-the-way-you-work/

Integrating accounting with payroll can be a great way to streamline financial processes and improve accuracy, but there are several things that customers should consider before making the switch.

Here are a few key factors to keep in mind:

- Security: Make sure both the accounting and payroll systems have robust security measures in place to protect sensitive financial data, such as employee social security numbers and banking information, before you integrate the two systems.

- Compatibility: The accounting and payroll software should be compatible with each other, and that data can be easily shared between them. Incompatible systems can lead to errors, duplicate data entry, and time-consuming workarounds.

- Reporting: The system should be able to generate reports that show key financial metrics and ensure that reports can be customized to meet your specific needs.

- Training: Integration will require some training of staff to use to familiarize themselves with new ways of work, including accessing reports and data entry procedures.

- Compliance: There are many compliance requirements that companies need to meet when it comes to payroll; it is essential to ensure that the integration of both systems meets all the local compliance requirements.

Seamlessly Integrate Payroll Accounting with Bayzat’s Latest Feature

- Automate the transfer of data between your payroll and accounting systems.

- Eliminate the need for manual data entry, reducing errors and saving time.

- Easily generate financial reports, track expenses, and manage employee payroll all in one place.

- Access real-time financial data and gain valuable insights into your business’s finances.

- Enhance security with industry-standard encryption and security protocols.

Get in touch today for a free demo!

Get Social