Payroll management software is at the top of the list for most businesses. The tool can make payroll a breeze, keep employees happy, and reduce the number of costs associated with running a successful business. Paying your employees on time and accurately is a vital tool for success.

Management of your payroll can happen in two different ways. You can either rely on an in-house payroll department or outsource it to a third party. So which is better for your business?

How Does In-House Payroll Work?

In-house payroll or payroll processing system that happens within your organization. You will have an in-house team in charge of everything related to payroll, and the department will manage employee benefits, process payroll and deal with any issues involved with the process. For most companies, in-house payroll is something your HR or internal financial department deals with.

The system can work efficiently if you have the right tools. Larger organizations can even develop unique in-house payroll software, although many opt for software to help with the process.

The most common tasks of in-house payroll processing involve things like:

- Establishing a payroll system and bank account for payments

- Implementing a system to track employee hours

- Creating a payroll schedule to make payments

- Approving timekeeping data to determine pay

- Managing other employee benefits, including healthcare deductions, taxes or other such payment benefits

- Tracking holiday and sick leave payments

If you want to develop your payroll software in-house, you will need the help of the IT team.

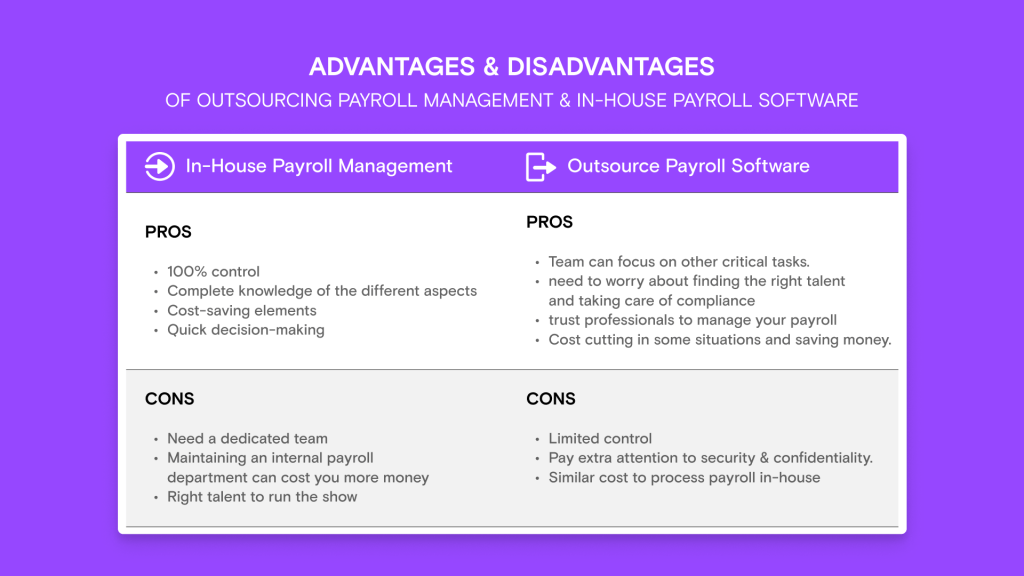

Advantages & Disadvantages of In-House Payroll Software

Keeping your payroll in-house can have plenty of benefits. The main advantages of in-house payroll are:

- 100% control of the payroll process.

- Complete knowledge of the different aspects, such as compliance and tax issues.

- Cost-saving elements since you are using an in-house team.

- Flexibility in regard to changes – especially those occurring on the 11th hour.

- Quick decision-making.

An in-house payroll management system can be effective and fast. Your HR & payroll software can respond to situations, and your team will have complete control over everything that goes into payroll management.

However, that does mean a few drawbacks. You need a dedicated team, and your HR has to be fully immersed in every payroll. On some occasions, maintaining an internal payroll department can cost you more money, and you could end up inflating your department numbers more than you can afford.

Payroll management includes a lot of compliance issues. You are dealing with a lot of data, and mistakes can be costly. Therefore, you do need to ensure you have the right talent to run the show.

How Does Outsourcing Payroll Management Work?

The other option for businesses is to outsource payroll management. As the name suggests, it means having a third-party to manage all the above responsibilities. You won’t need to worry about running the system, but you do need to ensure you find a reputable company to do it all for you.

Outsourcing your payroll management can look slightly different depending on the service provider. Most services require you to sign a contract with the service, and you follow the instructions they give to use their services. For example, these systems determine how and when you provide employee data and work hours. The service provider will then manage and process all this information. This includes processing payments, calculating vacation pay and so on.

External providers tend to have a specific team you’ll work with to ensure continuity and comfortability.

Advantages & Disadvantages of Outsourcing Payroll Management

Just like in-house payroll systems, outsourcing payroll management comes with its pros and cons. The most significant benefits to outsourcing – anything, really – but payroll in specific are:

- Your employees can focus on other, more critical tasks.

- You don’t need to worry about finding the right talent and taking care of compliance.

- You can trust professionals to manage your payroll.

- Cost cutting in some situations and saving money.

You can sleep rest assured that you are following all complicated compliance and labour laws. You will receive timely advice on how to deal with any issues you may have.

Payroll outsourcing does have its drawbacks, however. Like with any outsourcing, you will lose some control and oversight. You need to pay extra attention to things like security and confidentiality. Finding the right company will take a bit of time, and you still need to keep an eye on what is happening with your payroll.

In some situations, outsourcing can also end up costing a lot more. You may be paying for a service that your business could do internally.

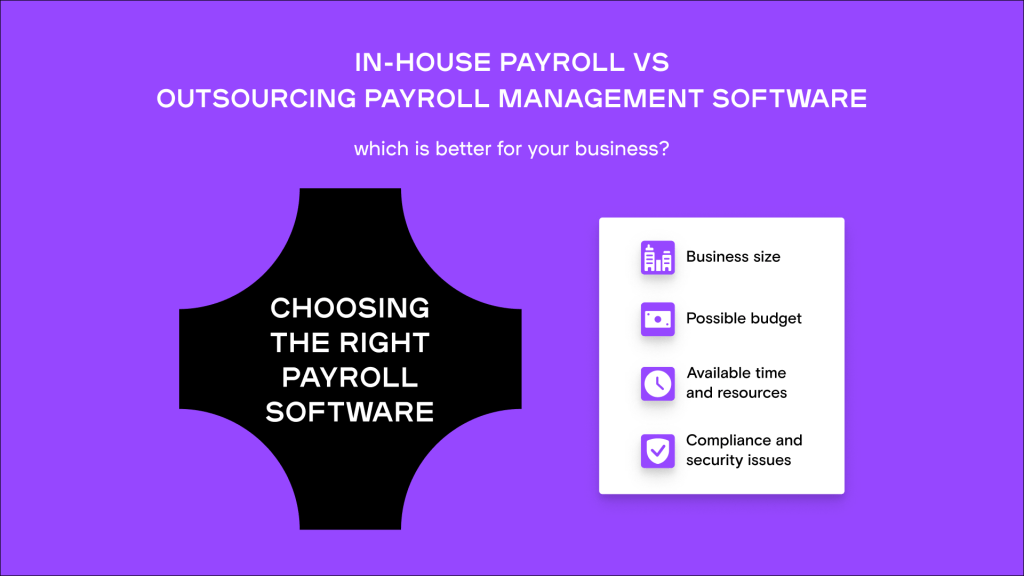

Choosing the Right Payroll Software in UAE

As you can see, payroll management can provide benefits whether you do it in-house or outsource it. Choosing the best payroll software system for your business in UAE can depend on the following main elements:

- Business size – For a small business, running an in-house payroll can end up costing a lot more than a larger corporation.

- Possible budget – You need to consider your potential budget and how much money you could save by comparing different options.

- Available time and resources – Consider the amount of time you can allocate to managing payroll. You also want to think about your current resources; perhaps you already have the talent to do it in-house.

- Compliance and security issues – Depending on the type of business you are running and where, you might have different compliance and security responsibilities. For example, for a multinational business, compliance can be much trickier than for a bigger firm only operating in the UAE.

The good news is that payroll processing in both cases is made easier with payroll software. Cloud payroll management can make it easier for in-house teams to deal with compliance issues or help you be a bigger part of the decision-making process when outsourcing.

The key is to consider the different options available to you. Look around and see how much payroll management software and its use would cost your business. You will figure out which of these systems works best for you.

You need to consider your business needs and its resources. Above all, make sure to find service providers that listen to those needs.

The Bottom Line

Good payroll management software can be a helpful tool to add to your organization. At Bayzat, we’ve made sure that our HR & payroll software works for businesses of different sizes. You can easily scale our cloud payroll management software as your business grows. You can also benefit from our comprehensive security and compliance guidelines. If you aren’t used to running a payroll system, you can find plenty of tools on our website to help you get started.

Payroll processing is time-consuming, and you need to get it right, as errors can cost a lot of money. The good news is that there are solutions for all situations. Your team can find the right payroll management software to do things in-house, or you can opt for a professional, third-party service to help you find business success.

Get Social