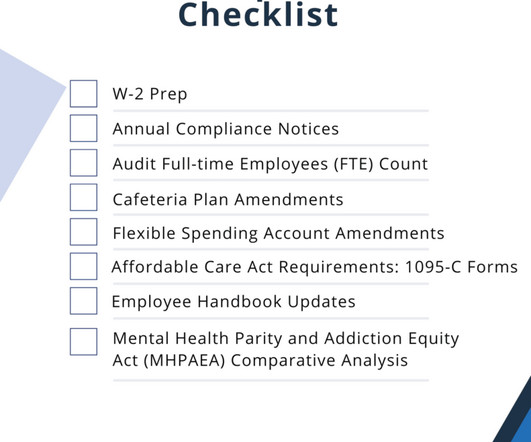

2021 Year-End Compliance Checklist

The Olson Group

DECEMBER 9, 2021

2021 has been another challenging, exciting, and ever evolving year for the business world. As 2021 comes to an end, here are some year-end tips and compliance guidance to ensure you are ready to kick off 2022 on the right track! Cafeteria Plan and Flexible Spending Account (FSA) Plan Amendments. Happy 2022!

Let's personalize your content