Useful Information from Recent Webinars- Part 3

Money Talk

JULY 6, 2023

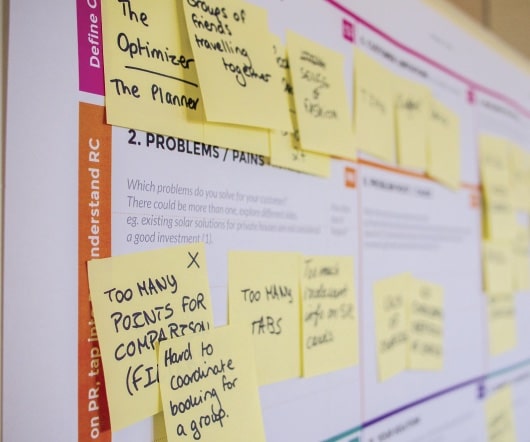

During the past two months, I summarized information from various recent webinars that might be useful to others. Super Savers - It is unlikely that people who saved for retirement for decades in tax-deferred plans will die without leaving some money in an IRA, 401(k), or other tax-deferred asset.

Let's personalize your content