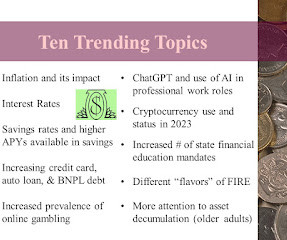

Ten Trending Topics in Financial Education

Money Talk

MAY 4, 2023

Today, I presented a general session program for financial educators and researchers at an online professional conference. My chosen topic was Ten Trending Topics in Financial Education. Inflation-induced price hikes on goods and services are like a regressive sales tax and hurt those with low incomes the most.

Let's personalize your content