Can Farmers Ever Afford to Retire?

Money Talk

APRIL 20, 2023

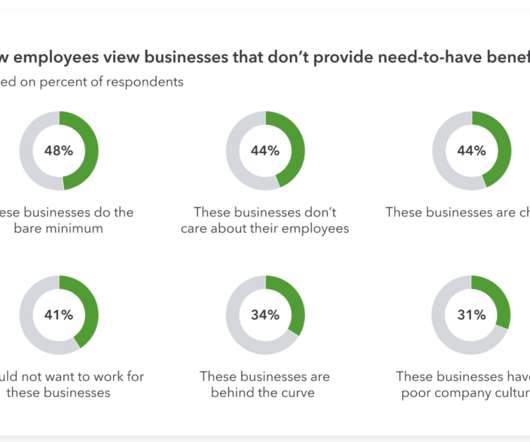

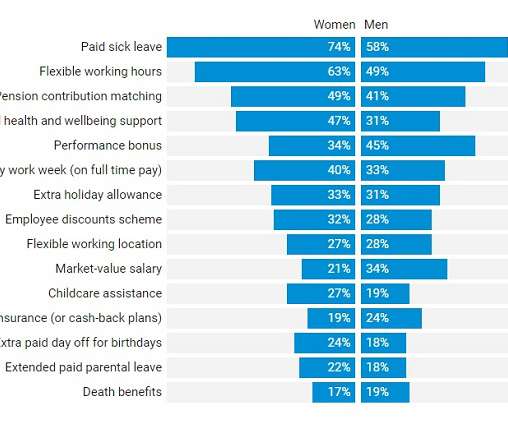

Off-Farm Job Employer Benefits - These include a defined benefit pension, an employer retirement savings plan (e.g., health insurance). Simplified Employee Pension (SEP)- This is a retirement savings plan for self-employed workers and small business owners. barn, silo, riding arena), farm equipment (e.g.,

Let's personalize your content