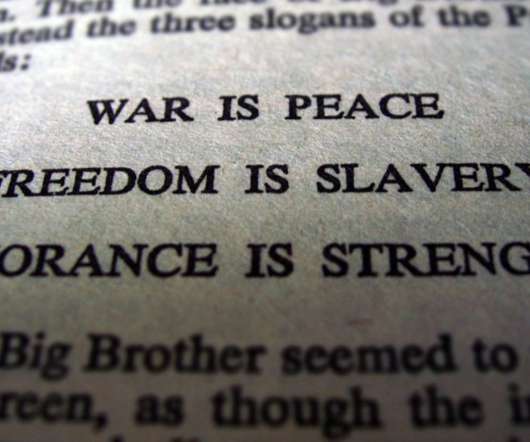

Orwellian NTSA Testimony From 2013

The Teacher's Advocate

SEPTEMBER 6, 2019

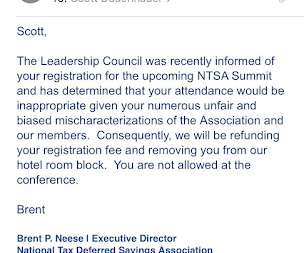

In 2013 the state of Pennsylvania was considering some changes to their retirement system which evidently called for a 401(a) plan for employer contributions. The NTSA wasn't happy about this because the money wouldn't be run through their vendors and agents, meaning no fees and commissions.

Let's personalize your content