Make the Most of Free Money

Money Talk

JANUARY 4, 2024

Free money does not have any work requirement, however, and is often income tax-free. Employer Match- This is money contributed to employees’ retirement savings accounts to match what they save. 50% for a fifty cent per employee dollar saved match) and is taxed as ordinary income in retirement.

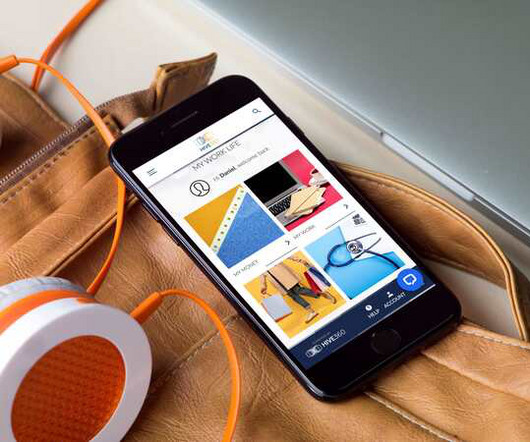

Let's personalize your content