Spring Budget 2023: Tax-free pensions allowance up by 50%

Employee Benefits

MARCH 15, 2023

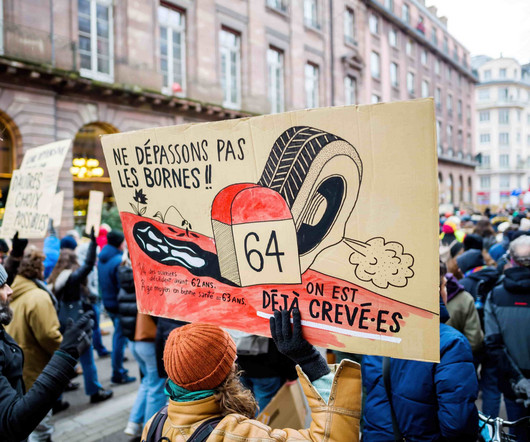

Spring Budget 2023: In his Budget address to the House of Commons today (15 March 2023), Chancellor of the Exchequer Jeremy Hunt addressed the issue of unpredictable pension tax charges causing employees to leave work, particularly within the NHS. No one should be pushed out of the workforce for tax reasons.”

Let's personalize your content