Off-the-shelf vs configurable HR software: what’s right for you?

cipHR

MAY 2, 2023

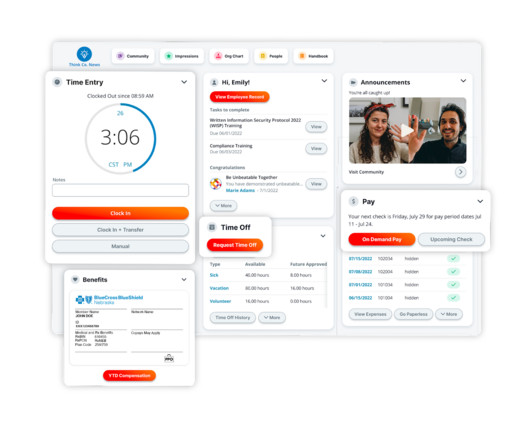

HR software has become an integral part of modern business operations, making it easier for HR professionals to manage all of the employee lifecycle. With the growing demand for HR software, businesses are now faced with the dilemma of choosing between off-the-shelf HR software and HR systems that offer a greater degree of configurability.

Let's personalize your content