SECURE 2.0 Delivers New Rules for Correcting Retirement Plan Errors

Proskauer's Employee Benefits & Executive Compensa

JANUARY 3, 2023

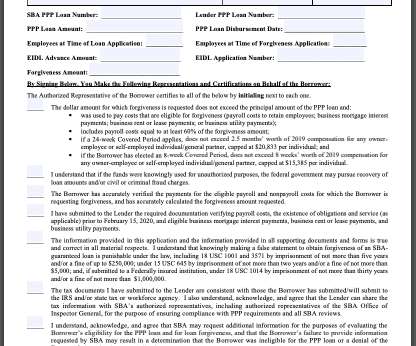

was signed into law on December 29, 2022 , making it important for plan sponsors and plan administrators to familiarize themselves with the new rules. Correction of Retirement Plan Overpayments. changes how retirement plan overpayments are corrected in two key ways, which are detailed below.

Let's personalize your content