Employers Must Use New Form I-9 by November 1

PayrollOrg

OCTOBER 24, 2023

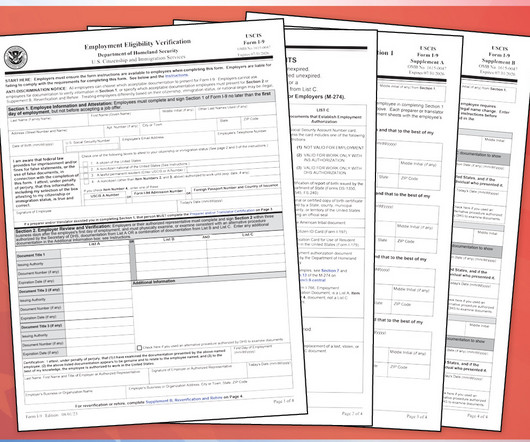

Starting November 1, employers must use the version of Form I-9, Employment Eligibility Verification, with an edition date of 8-1-23.

forms

forms

PayrollOrg

OCTOBER 24, 2023

Starting November 1, employers must use the version of Form I-9, Employment Eligibility Verification, with an edition date of 8-1-23.

PayrollOrg

MARCH 6, 2024

The IRS released the 2024 Form 941, Schedule B, and Schedule R, along with their respective instructions. The lines on the form used to report COVID-19-related credits have been removed.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

International Foundation of Employee Benefit Plans

FEBRUARY 28, 2024

The latest Talking Benefits podcast episode dives into family forming benefits, or any benefit that is helpful in assisting workers in starting or growing a family. It can take the form of a specific benefit offering or time off on either a […] The post Family Forming Benefit Trends appeared first on Word on Benefits.

PayrollOrg

OCTOBER 17, 2023

PayrollOrg’s Government Relations Task Force commented on the IRS’s information collection notice on federal employment tax forms in September.

Advertiser: Paycor

Did you know anything from mishandled I-9s to late EEO forms and incorrect recruiting or promotion practices can result in fines, litigation and penalties? There are 7 risks every HR leader needs to know now, and tips on what to do about them, in this new guide from Paycor.

PayrollOrg

AUGUST 1, 2023

Citizenship and Immigration Services (USCIS) published the revised Form I-9, Employment Eligibility Verification, with an edition date of 8-1-23. On August 1, U.S.

PeopleKeep

OCTOBER 4, 2023

On your first day of employment, you decide how much federal income tax your employer can withhold by filling out Form W-4. Using the form, you can account for additional income, dependents, tax credits , and deductions to determine the right amount to withhold for your specific circumstances.

Speaker: Leslie Neitzel, Chief Human Resource Officer

Every country handles rules and regulations around fertility care and family forming differently. In this session, you will learn: The differences in fertility and family-forming access across Latin America, Asia, Europe, and the U.S. Cultural differences play a role in care access as well.

Speaker: Jackie Blanco, RN, BSN, Senior Manager of Medical Operations at Carrot Fertility & Nate Fournier, Enterprise Account Executive, Carrot Fertility

Fertility and family-forming benefits are becoming a must-have benefit for attracting and retaining top talent, but for those who aren’t familiar with fertility health, it might not be clear why this is a workplace topic and what supportive benefits should include.

Speaker: Taylor Padalino - Account Executive, Enterprise Partnerships

Fertility treatments and other family-forming journeys like adoption are notoriously expensive, costing tens of thousands of dollars on average. It may seem counterintuitive, then, that providing employees with fertility benefits can actually help reduce healthcare and other costs.

Speaker: Leslie Neitzel, Chief Human Resource Officer

Providing financial support for fertility and family-forming helps make journeys possible for many employees. Understand how clinical management can reduce costs and stress associated with IVF and other fertility and family-forming journeys. But money isn't the only factor; comprehensive fertility benefits involve much more.

Let's personalize your content