Understanding Taxable Benefits In A Quick and Easy Way

Vantage Circle

JANUARY 30, 2022

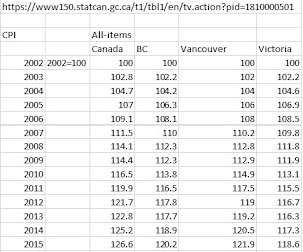

Group-term life insurance coverage. Transportation (commuting) benefits. Some examples are retirement benefits, child care, health insurance, employee rewards, disability insurance, etc. Most taxable benefits are subject to Canada Pension Plan, Employment Insurance, and income tax deductions.

Let's personalize your content