Why employers should add child disability insurance to their benefits suite

Employee Benefit News

JUNE 3, 2024

Juno is the first company to offer child disability insurance for workers in the U.S. Do employers need it?

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Disability Insurance Related Topics

Disability Insurance Related Topics

Employee Benefit News

JUNE 3, 2024

Juno is the first company to offer child disability insurance for workers in the U.S. Do employers need it?

Employee Benefit News

SEPTEMBER 19, 2024

Employers are updating parental leave policies and adding supplemental child disability insurance to help support parents.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Employee Benefit News

FEBRUARY 22, 2024

Conway is representing a plaintiff who was denied disability coverage by Hartford Life and Accident Insurance Company. ERISA attorney J.J.

Employee Benefit News

SEPTEMBER 3, 2024

Employers may want to consider alternatives that offer coverage that comes with a reduced financial impact on employees.

BerniePortal

APRIL 29, 2022

Employers often offer ancillary benefits like disability insurance as part of the enrollment process , but unlike health coverage , not all employees will need ancillary benefits. So, what is disability insurance? Here’s what you need to know, including the difference between short- and long-term disability coverage.

InterWest Insurance Services

OCTOBER 31, 2024

Over 80% of middle-market respondents report that they got their health insurance, disability insurance and retirement plan all through their employer. Meanwhile, six in 10 have no life insurance in place outside of the workplace. Are life insurance benefits adequate?

CorpStrat

MARCH 21, 2024

If your company provides Employee Benefits, there’s a good chance you’re enrolled in a Group Disability Insurance plan. We’ve observed a common trend: many Group Disability programs are neglected and outdated. Failing to do so may result in missed opportunities for cost savings or better coverage.

Patriot Software

MARCH 14, 2022

In some cases, the employee must receive short-term disability insurance benefits. But, that all depends on whether you decide to offer it—or whether your state forces you to due to a state disability insurance program. What happens? Does yours? Let’s […] READ MORE.

PayrollOrg

DECEMBER 27, 2023

Effective January 1, 2024, there is no California state disability insurance (SDI) taxable wage base limit, which means there is no cap on the amount of employee contributions for SDI.

BerniePortal

AUGUST 17, 2021

When it comes to disability leave and disability insurance, there’s a lot that employers need to know in order to best support their teams. Many people refer to disability benefits, insurance, and leave interchangeably, but the differences are significant when it comes to compliance and benefits administration.

CorpStrat

FEBRUARY 12, 2024

We’re talking about things like illness, disability, or the loss of a key team member. This is where the importance of employee benefits, key person insurance, and disability insurance comes into play. Protecting Your Business MVPs Most companies have health insurance to cover medical expenses and illnesses.

Patriot Software

JUNE 18, 2024

One of the taxes you must withhold from employee wages is the Old-Age, Survivors, and Disability Insurance (OASDI) tax. Tax withholding is an essential piece of the payroll puzzle. You must also contribute an employer portion of the OASDI tax. OASDI tax is more commonly referred to as Social Security tax.

WEX Inc.

JULY 10, 2024

For example, younger employees might benefit from budgeting tools and renters insurance, while older employees might be more interested in long-term care and disability insurance. .” Employers should consider the unique needs of different demographic groups within their workforce.

Fringe Benefit Analysts

MARCH 2, 2022

That’s where disability insurance comes in. What is Disability Insurance? Disability insurance can replace your lost income if you’re unable to work due to illness or injury. Think of it as insurance for your paycheck, which is likely your most valuable asset. Who needs disability insurance?

Higginbotham

MARCH 2, 2023

Workers’ compensation and disability insurance are two different types of programs that can provide benefits. Learn about the differences between workers’ compensation vs disability insurance and why your workers may need access to both. What are disability insurance benefits?

Higginbotham

JULY 17, 2023

If you’re someone who’s familiar with the intensity of that commitment, have you considered what would happen to your business if you were unable to work due to a disability? In this article, we will explore the importance of disability insurance for business owners and how it can help protect your livelihood in times of need.

Higginbotham

AUGUST 25, 2023

It’s a real risk, and it’s why anyone who depends on a paycheck needs to understand the importance of disability insurance. Why is disability coverage important? If you had a one-in-four chance of losing your house to a flood , you’d probably want to protect it with flood insurance. Savings can deplete fast.

Workers' Compensation Perspectives

AUGUST 27, 2023

[The following notes background and discussion points from a series of sessions Disability Management undergraduates completing a 4 th year course on Workplace Insurance and Benefits. Part 1 explores the reasons for the lack of trust in disability insurance. The trust gap is not unique to the disability insurance sector.

Winston Benefits

OCTOBER 11, 2016

This avoidance can have dire consequences, because the Social Security Administration says more than a quarter of today’s 20-year-olds will be disabled at some point before age 67. Communicating about disability insurance takes discretion and compassion as you debunk misunderstandings about the product.

CorpStrat

JULY 15, 2021

That’s where Group Disability Insurance comes in. Group Disability Insurance is: 1.) Some people are under the false impression that Group Disability Insurance is expensive. In the event of the unthinkable, NOT having Group Disability Insurance is far more costly. Extremely affordable.

Workers' Compensation Perspectives

APRIL 29, 2024

Many workers’ compensation jurisdictions and work-disability insurers have noted increasing mental disorder (also called psychological injury, mental injury) claims over time. US Social Security provides benefits to workers for certain disabilities. In this post, we survey some of the data reflecting this increase.

Workers' Compensation Perspectives

SEPTEMBER 23, 2023

[This is the second part of a discussion on the Disability Insurance “trust gap”. It is based on notes and discussions points for sessions in a 4th year Disability Management course on Workplace Insurance and Benefits. Part 1 explored the reasons for the lack of trust in disability insurance.

Winston Benefits

OCTOBER 20, 2016

Most workers consider health and retirement plans their most important benefits, but they should also be weighing the importance of disability insurance , especially younger workers who may not immediately see its value.

Workers' Compensation Perspectives

JULY 4, 2024

The apparent rise in mental disability claims is a significant issue for disability insurers and workers’ compensation systems. I accept the following as a fundamental principle for workers’ compensation: If work is the cause of injury and disability, then the compensation and treatment should be funded by the employer.

Workers' Compensation Perspectives

JUNE 2, 2024

On the disability insurance side, this shift has meant changes to policies and procedures. While not everyone has access to disability plans, insured parties want clarity of the coverage; insurers need clear procedures to approve coverage. The toughen-up attitude still exists.

Money Talk

AUGUST 10, 2022

A new job may also provide access to valuable employer term life and disability insurance. By doing this, they avoid having to make monthly premium payments for Medicare Parts B, C, and/or D while they are working. The coverage must be deemed creditable or late enrollment penalties will apply. food, gas, utilities, housing, etc.)

CorpStrat

DECEMBER 29, 2023

However, the concepts of long-term care insurance and disability insurance can sometimes be muddled, creating confusion in the minds of many. Integral Components of Financial Planning: Both these insurance types are integral components of a well-rounded financial plan, and their importance cannot be overstated.

HR Lineup

NOVEMBER 30, 2021

Life insurance. Disability insurance. Accident insurance, and more. Here are some of the employee benefits your business will enjoy when they partner with a PEO. Medical coverage, including dental and vision. Educational assistance. Drug testing. Retirement benefits. Assistance in adoption.

Winston Benefits

MAY 14, 2020

Seventy-one percent of employees say that because of the benefits they receive at the workplace, they … Continue reading "Ensuring Financial Health with Disability Insurance". The post Ensuring Financial Health with Disability Insurance appeared first on Winston Benefits.

Winston Benefits

MAY 14, 2020

Seventy-one percent of employees say that because of the benefits they receive at the workplace, they … Continue reading "Ensuring Financial Health with Disability Insurance". The post Ensuring Financial Health with Disability Insurance appeared first on Winston Benefits.

HR Lineup

FEBRUARY 14, 2023

The company’s employee benefits offering includes group medical, dental, vision, life and disability insurance, as well as employee wellness programs and voluntary benefits. In the realm of employee benefits, Hub International provides businesses with a range of insurance products to help protect their employees.

InterWest Insurance Services

JULY 26, 2022

You as an employer can help by offering group disability insurance to your employees. This insurance helps replace a portion of a worker’s income if they lose their income due to an injury or illness. Typically, disability insurance policies will replace between 50 and 65% of a worker’s income.

Higginbotham

OCTOBER 29, 2024

Their expertise lies in understanding the insurance landscape and creating benefits packages that meet the unique needs of an employer’s workforce. This involves tailoring core benefits like health, dental and vision insurance while incorporating voluntary options, such as disability insurance, mental health benefits or life insurance.

Attorney Charlie Hall

DECEMBER 31, 2021

Disabled veterans can apply and get Social Security Disability Insurance at the same time as Veteran Administration (VA) Disability Compensation. Getting approved for disability benefits provides increased income stability for veterans and their families.

Patriot Software

SEPTEMBER 7, 2022

You and your employees need to know about short-term vs. long-term disability insurance. You can offer short-term and long-term disability insurance options for your […] READ MORE. What happens if an employee gets injured or ill and can’t work for an extended period of time?

HR Digest

MAY 21, 2023

Health insurance 2. Dental or vision insurance 4. Considering health care and life insurance 5. Retiree health insurance 6. Disability insurance Looking at these results, it’s clear that financial security is a major driver of employee benefit choices. Pension or retirement savings plan 3.

Winston Benefits

MAY 19, 2021

With numbers like these, it’s shocking to realize that 110,000,000 Americans don’t have long-term disability insurance, and 48% of U.S. In addition, 5.6% … Continue reading "The Importance of Disability Insurance and Why Your Company Should Offer Multiple Options".

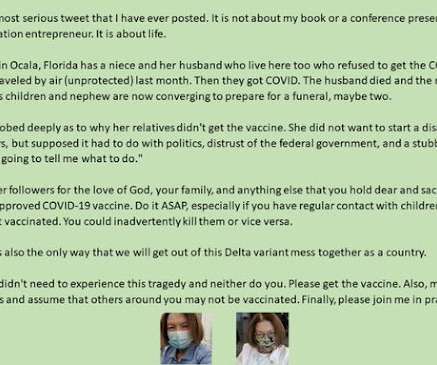

Money Talk

SEPTEMBER 1, 2021

When unvaccinated people lack health or disability insurance or die without life insurance, the situation is even more dire for survivors, who may need to seek public assistance to get by. Wealth Depletion - As noted above, COVID-19 is expensive.

CorpStrat

DECEMBER 4, 2024

Promote Ancillary Benefits Ancillary benefits like dental, vision, disability insurance, and voluntary offerings such as pet insurance or legal support can significantly enhance your package. Are you paying for benefits employees don’t use? Adjust your offerings to maximize employee satisfaction and your return on investment.

Corporate Synergies

SEPTEMBER 24, 2018

It’s important to educate employees on how long-term care and long-term disability insurance differ from each other. So it stands to reason that there’s a resurgence of interest in long-term care and long-term disability insurance. Rates may increase only by a class action that is approved by state insurance regulators.

Genesis HR Solutions

SEPTEMBER 22, 2020

There are four major types of employee benefits many employers offer: medical insurance, life insurance, disability insurance, and retirement plans. Medical Insurance. Medical insurance is likely a no-brainer— it’s one of four major types of benefits most employers offer. Disability.

HR Lineup

FEBRUARY 14, 2023

They offer a range of products and services, including health insurance, retirement plans, life insurance, and disability insurance, as well as voluntary benefits such as pet insurance, legal services, and more. These offerings are customized to meet the unique needs of each organization and their employees.

HR Lineup

FEBRUARY 13, 2023

This includes the enrollment process, claims management, and administration of benefits such as health insurance, life insurance, disability insurance, and more. Vena’s employee benefits module provides a centralized platform for managing all aspects of employee benefits.

HR Lineup

MAY 10, 2023

PlanSource also provides a range of insurance plans to employees, including health, dental, vision, life, and disability insurance. The platform works with some of the largest insurance carriers in the country, allowing employers to offer a wide range of insurance options to their employees.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content