Your Guide to Take-home Pay

Patriot Software

SEPTEMBER 9, 2022

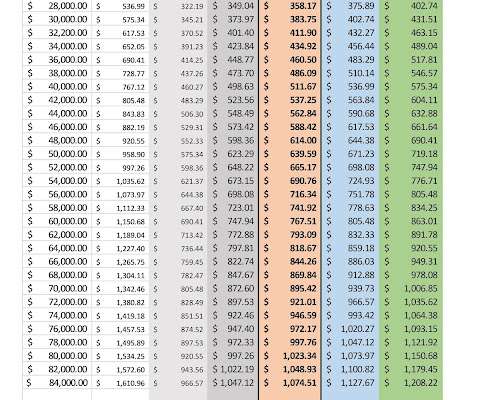

After you subtract all of the taxes and other deductions, money left over is considered take-home pay. Read on to learn more about what is take-home pay and how to calculate it. What is take home pay? Take-home pay consists of the […] READ MORE.

Let's personalize your content