How much will I get while on workers’ compensation?

Workers' Compensation Perspectives

DECEMBER 27, 2019

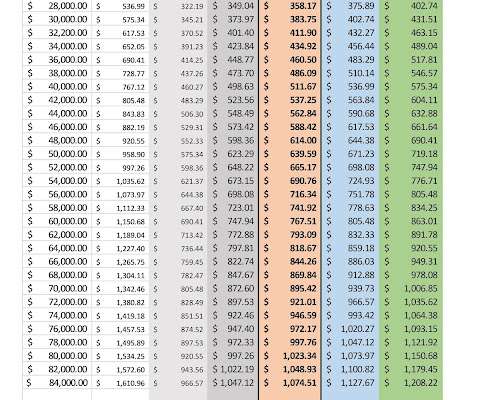

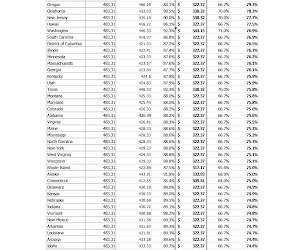

The inequity of the “two-thirds” of average earnings compensation rate was highlighted in the National Commission on State Workmen’s Compensation Laws (1972) report. The Commission, chaired by John F. noted that gross pay results in inequities—uneven results for workers due to tax factors and number of dependents, concluding “.spendable

Let's personalize your content