In-house vs outsourced payroll: what’s the difference?

cipHR

JULY 25, 2022

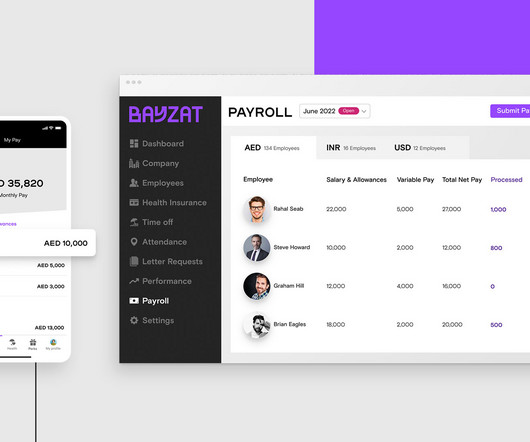

Paying your employees is imperative, but should you use in-house payroll software or an outsourced payroll provider? The question is: do you build your own team of in-house experts, or do you outsource payroll to a specialist supplier? In-house payroll vs outsourced payroll: at a glance.

Let's personalize your content