Your Guide to Take-home Pay

Patriot Software

FEBRUARY 25, 2019

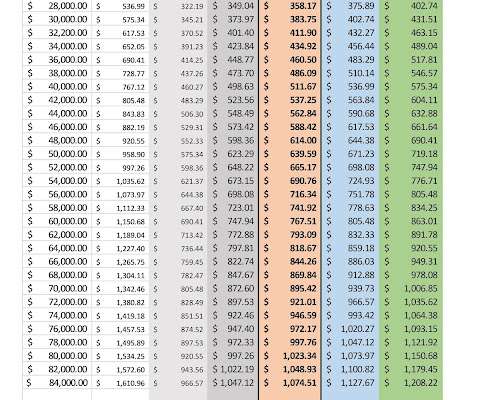

As an employer, you are responsible for withholding various taxes from employees’ wages. After you subtract all of the taxes and other deductions, money left over is considered take-home pay. Read on to learn more about what is take-home pay and how to calculate it. What is take home pay?

Let's personalize your content