What is a total compensation statement & how does it provide value?

Genesis HR Solutions

JULY 3, 2019

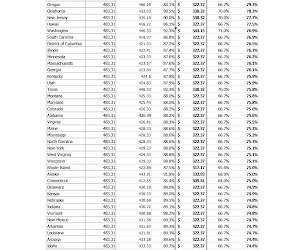

This includes gross wages and extra financial compensation, such as bonuses or commissions, as well as the employer-paid portion of retirement plan contributions, insurance premiums, and paid time off benefits. Commissions. Base pay/overtime. Commission/bonuses/incentive pay. Indirect Compensation: Taxes.

Let's personalize your content