Payroll Process: A Comprehensive Guide to Payroll Processing

Qandle

DECEMBER 5, 2023

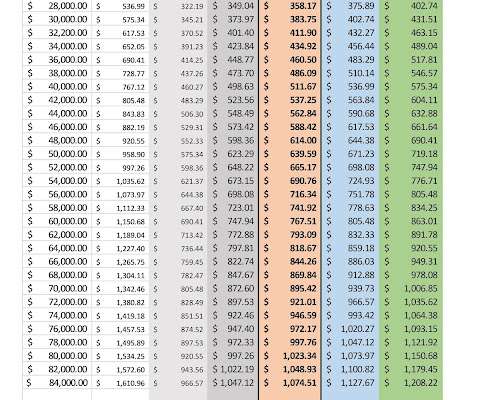

Understanding Payroll Processing: At its core, payroll processing involves calculating employee compensation, including salaries, wages, bonuses, and deductions. Deductions for income tax, social security, and other statutory requirements must be precisely calculated and remitted. Looking for the Best HR Payroll Process ?

Let's personalize your content