Workers’ Compensation: What’s payroll got to do with it?

Workers' Compensation Perspectives

SEPTEMBER 30, 2019

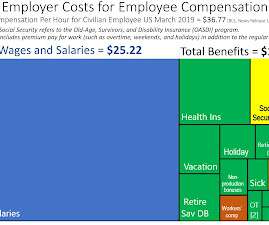

A recent study of manufacturing hourly compensation demonstrated a similar pattern for the main components (social insurance, wages or salaries, and direct benefits) paid by employers in Canada and Australia: The main divisions of employer costs for employee compensation under the BLS study are wages or salaries and benefits.

Let's personalize your content