Why “high deductible” shouldn’t be treated like a dirty word

Benefit Resource Inc.

AUGUST 13, 2019

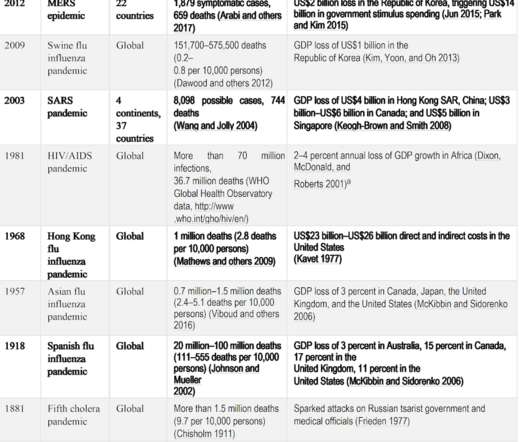

The term “high deductible health plan” has often carried with it a negative connotation for employees. Additionally, a “high deductible” is not as high as you think. In 2007, 17.4 tax savings, preventative care services before deductible is met, compounding interest, etc.). to 46% in just 11 years.

Let's personalize your content