In-House Payroll vs Outsourcing Payroll Software: Which is Better?

Bayzat

MARCH 21, 2023

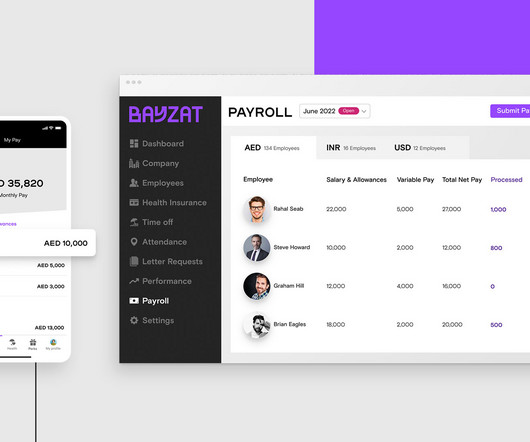

Last Updated on March 21, 2023 by user In-House Payroll vs Outsourcing Payroll Software: Which is Better? Payroll management software is at the top of the list for most businesses. The tool can make payroll a breeze, keep employees happy, and reduce the number of costs associated with running a successful business.

Let's personalize your content