What are The Pre-Payroll activities? A detailed overview

Qandle

JUNE 20, 2023

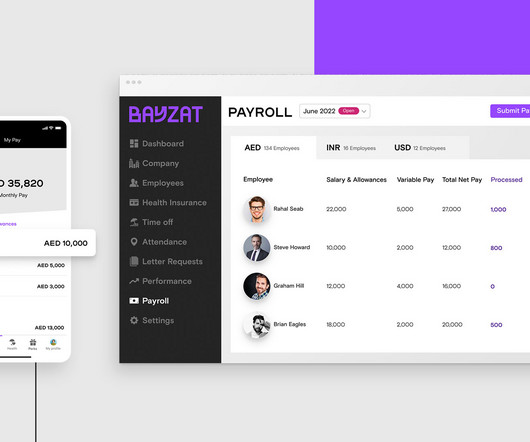

This includes employee details such as names, addresses, social security numbers, tax withholding information, bank account details for direct deposit, and any changes in employment status or compensation. This may involve collecting timesheets, time clock records, or electronic time tracking data.

Let's personalize your content