Fiscal drag: how can employers offset the challenges of a difficult economy?

Employee Benefits

APRIL 22, 2024

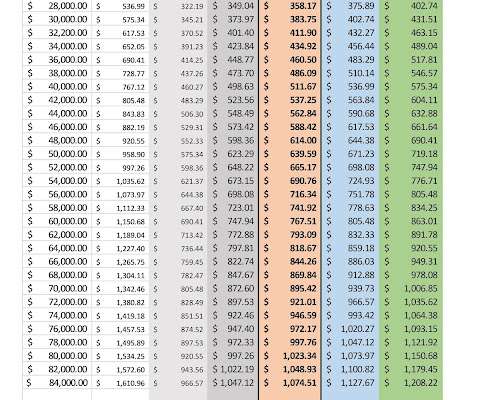

The frozen tax thresholds could see some employees ‘dragged’ into paying more tax and have less disposable income as a result. Employers should ask employees about their financial pressures to understand how to support them. In order to combat this, how can employers help manage employees’ financial pressures ?

Let's personalize your content