Everything employers need to know about W-2 compliance

Business Management Daily

OCTOBER 14, 2021

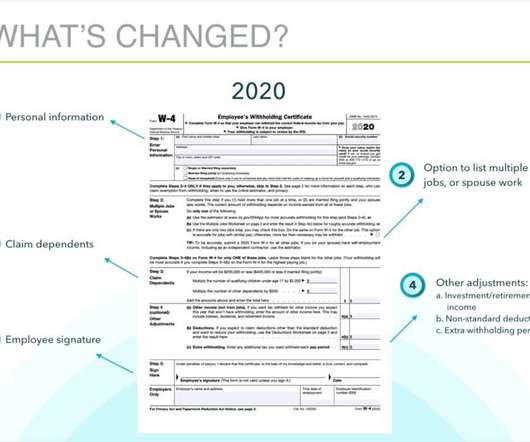

For businesses and employers, that means end-of-year accounting and W-2 filing is right around the corner. Form W-2 is the Wage and Tax Statement that employers use to report wages paid to employees. These are the tax forms that your employees need to file their yearly tax returns. 2021 is coming to a close.

Let's personalize your content