Are wages or salary fully covered by workers’ compensation insurance?

Workers' Compensation Perspectives

OCTOBER 29, 2019

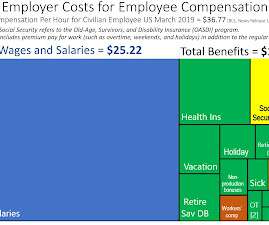

A December 2018 slip and fall in a wet stairwell of her employer’s office building resulted in a back injury and a cracked rib. The formula for calculating net or spendable earnings may vary but is generally considered as Gross earnings less income taxes (state/federal/provincial) and other mandatory deductions. Burton, Jr.,

Let's personalize your content