Temporary Total Disability for Work injury: What will Workers’ Compensation pay?

Workers' Compensation Perspectives

MARCH 4, 2021

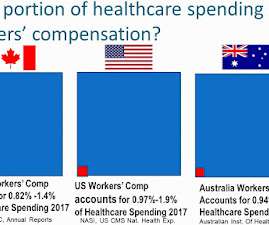

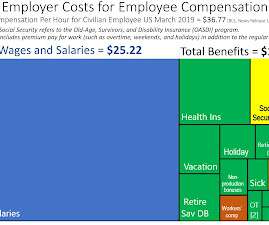

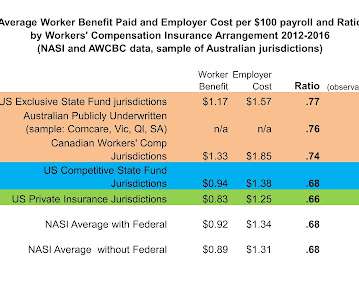

In the accompanying slides and in some responses, I provide additional references as a starting point for understanding and comparing initial workers’ compensation. All workers’ compensation systems pay the same rate for lost wages…right? At lower income levels, no income tax may be payable.

Let's personalize your content