The secret to having a comprehensive benefits package

Benefit Resource Inc.

JANUARY 7, 2021

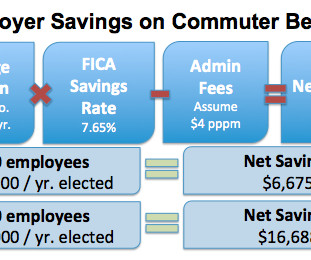

As an employer, you want your benefits package to be a one-stop-shop for your employees. Not only will a comprehensive benefits package keep your current employees happy, but it will help you attract new talent. We’re here to let you in on a secret to help you kick your benefits up a notch. Post-deductible.

Let's personalize your content