Meal Cards Decoded: A Step-by-Step Guide for Implementing and Utilizing Employee Meal Benefits

Empuls

JUNE 18, 2023

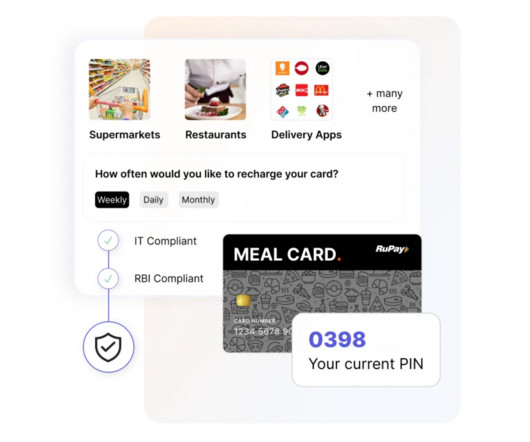

In today's fast-paced work environment, employers increasingly recognize the importance of providing employee meal allowances. In this complete guide, we will explore the concept of meal cards, their significance, and how you can introduce them in the workplace for the benefit of employees and employers. What are meal cards?

Let's personalize your content