Is Outsourcing Payroll a Bad Idea?

Stratus.HR

FEBRUARY 15, 2022

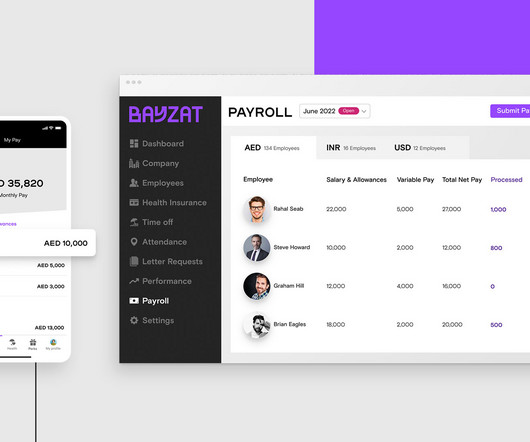

When you hear news of a security breach from a major payroll service provider , it begs the question: is outsourcing your business’s payroll a bad idea? Security Breach: Is Outsourcing to a Payroll Company Worth It? Vulnerability for Unpaid Bills: Is Outsourcing to a Payroll Company Worth It?

Let's personalize your content