What Are Post-tax Deductions From Payroll?

Patriot Software

AUGUST 31, 2022

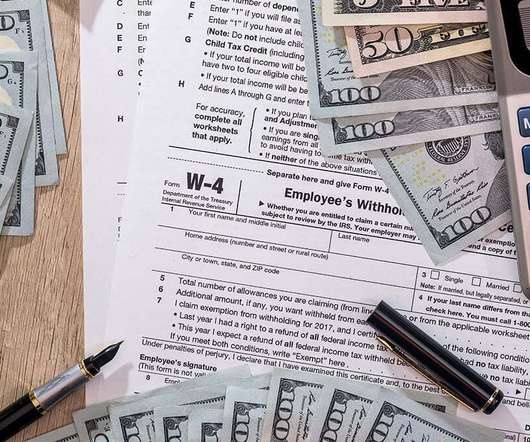

You also need to subtract deductions from payroll. Deductions include taxes, pre-tax deductions, and post-tax deductions from payroll. You will deduct post-tax deductions after you withhold pre-tax deductions and taxes.

Let's personalize your content