Choosing the best workplace pension for your business

Employee Benefits

JULY 25, 2023

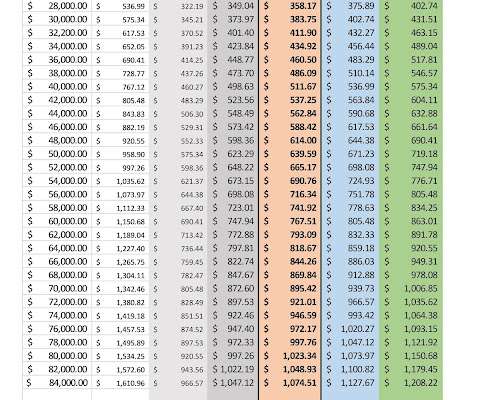

You can aid your employees and business in saving considerable amounts: If you neglect to periodically review your pension, your company might be losing money that could be allocated towards pay raises or bonuses. Relief at Source pension contributions from your employee are taken after tax deduction. What is a workplace pension?

Let's personalize your content