If You’re Paid Biweekly, You’ll Probably Get an Extra Paycheck in 2020

HR Digest

JANUARY 8, 2020

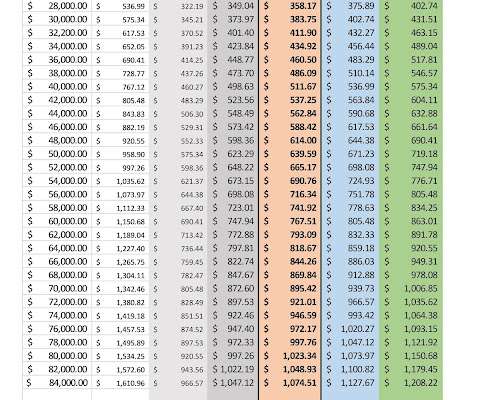

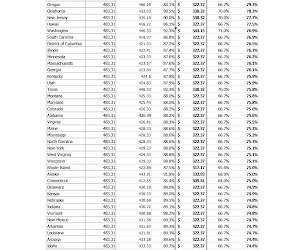

It depends on how your employer will manage this unusual year. Some employers may choose to divide employees’ annual salary over 27 pay periods instead of 26. This means that gross pay would be 3.7% lower each pay period during 2020 (although you’d make the same total salary).

Let's personalize your content