TriNet

HR Lineup

OCTOBER 6, 2023

TriNet’s HR services encompass various critical areas, including payroll processing, benefits administration, risk management, compliance, and talent management.

HR Lineup

OCTOBER 6, 2023

TriNet’s HR services encompass various critical areas, including payroll processing, benefits administration, risk management, compliance, and talent management.

HR Lineup

DECEMBER 28, 2022

Resourcing Edge’s payroll services are designed to make it easy for businesses to manage payroll and employee benefits. This includes processing payroll, providing employee self-service portals, and handling tax compliance and reporting.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Stratus.HR

OCTOBER 16, 2020

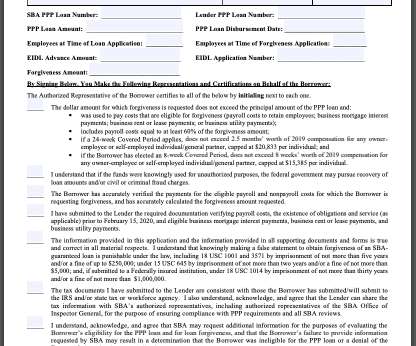

Payroll Documentation for Form 3508S: Documentation verifying eligible compensation and benefits during the covered or alternative payroll covered period, including: Bank account statements or payroll service provider reports documenting cash compensation paid to employees. Tax forms or payroll service provider reports.

Insperity

FEBRUARY 11, 2021

Payroll processing is tedious and time-consuming, so choosing the right method for tackling it is a critical first step. Use a payroll service. Using an automated payroll service can help you avoid hassles and headaches without being as costly as hiring an accountant. Correct and consistent payroll.

Qandle

SEPTEMBER 6, 2023

Account for Benefits: Deduct employee contributions for benefits like health insurance, retirement plans, and other voluntary deductions. Payroll can be categorized into four main types: In-House Payroll: Companies manage payroll internally using manual calculations or Excel spreadsheets.

Business Management Daily

MARCH 21, 2022

It’s important to take care of the people that work to keep your business alive, and helping them plan for their retirement is a great way to do that. 401(k)s allow employees to set aside a percentage of their salary to plan for their future retirement. What is a 401(k)? Choose a 401(k) partner.

Patriot Software

MARCH 4, 2019

The employee elected to contribute to a retirement plan. If an employee elected to contribute to a pre-tax retirement plan, their W-2 Box 1 wages are likely lower than their Box 3 wages. An employee’s elected retirement plan contributions are not subject to federal income taxes.

Let's personalize your content