Are Workers’ Compensation benefits protected against the rising cost of living?

Workers' Compensation Perspectives

JANUARY 1, 2019

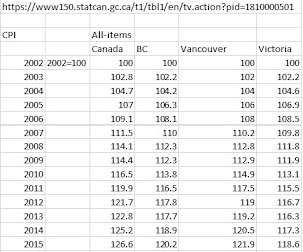

To forestall this eventuality, the majority of North American workers’ compensation jurisdictions adjust periodic payments (sometimes called workers’ compensation pensions or permanent disability payments) to account for increases in the cost of living. No COLA was payable in January 2010, January 2011, or in January 2016.

Let's personalize your content