India’s Payroll Processing: A Comprehensive Step-by-Step Guide

Qandle

AUGUST 3, 2023

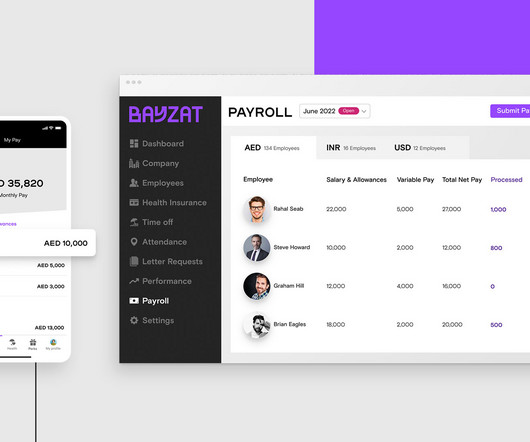

Payroll processing is a critical function in any organization, including those operating in India. This guide presents a comprehensive step-by-step procedure for payroll processing in India, including the techniques and stages involved. Looking for the Best Payroll Software ? Check out the Payroll Software.

Let's personalize your content