How to Effectively Manage Payroll Services?

Qandle

APRIL 7, 2022

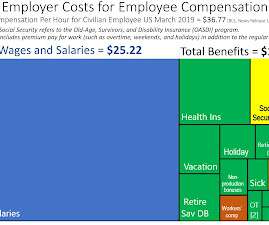

Payroll administration is the difficult task of keeping track of your employees’ financial data, such as pay, benefits, taxes, and deductions. Calculating your employees’ salary, issuing payments, preserving payroll records, and collecting tax forms are all part of payroll management. The phase of payroll processing.

Let's personalize your content