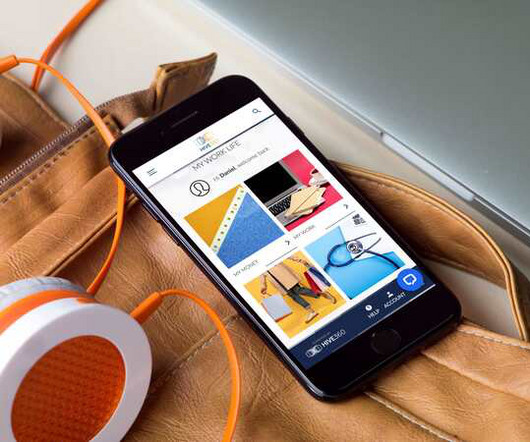

HIVE360’s employee benefits and rewards app, Engage

Employee Benefits

JUNE 8, 2023

It is leading the way in innovating employer engagement via its suite of employee benefits that match individual business requirements with a tailored, personal solution, to provide a ‘bridge’ between an employer and its workforce with pioneering technology-based solutions. For more information: www.hive360.com

Let's personalize your content