The benefits offered by Wave

Employee Benefits

JANUARY 25, 2023

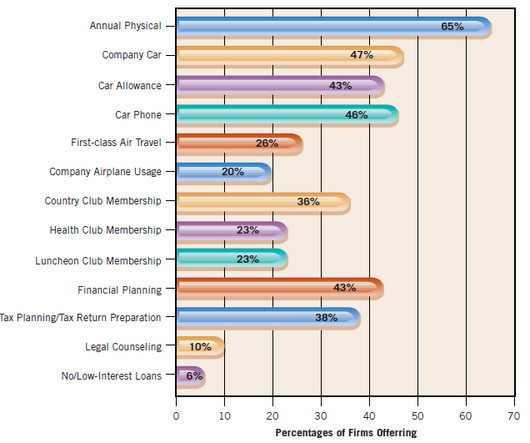

Matching contribution levels: 3% employee contribution, 6% employer; 4% employee 8% employer; 5% employee and 10% employer. Annual employer-funded health screening for the leadership team. Group income protection employer-paid for all employees, subject to acceptance by the insurer. 26 weeks deferred period.

Let's personalize your content