Meal Cards Decoded: A Step-by-Step Guide for Implementing and Utilizing Employee Meal Benefits

Empuls

JUNE 18, 2023

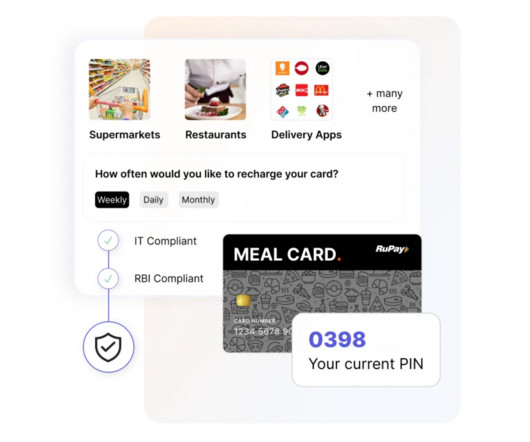

Employees can maximize their tax benefits and potentially increase their take-home pay by utilizing meal cards. 💡 Try Xoxoday Empuls : Hassle-free utilization of tax-free allowances. This can result in savings for both employees and employers. Here are some of them: 1.

Let's personalize your content