Is relocation reimbursement taxable? How to assess tax liability for employee relocation

Business Management Daily

AUGUST 31, 2023

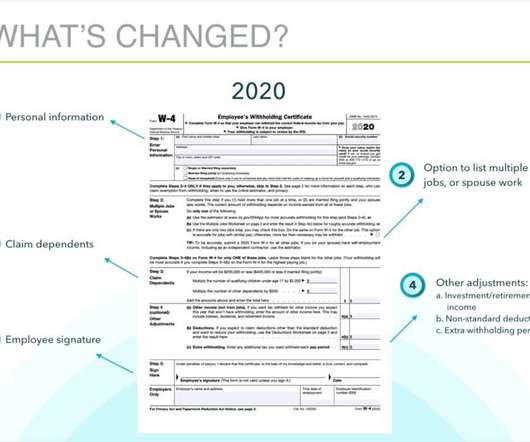

Expenses that could previously be deducted on an employee’s tax return may no longer qualify, and relocation benefits that previously could be paid out without counting towards a taxpayer’s income may now result in higher tax liabilities. Can employees deduct their moving expenses? What is a relocation reimbursement?

Let's personalize your content